There is a big increase in the number of vegetarians in the European countries. The number of vegetarians and number of consumers who are reducing their meat consumption has been increasing in European over recent years. Environmental, ethical and health reasons are largely responsible for this – depending on the type of consumer. Other reasons are an increased consumer interest in variation and in “new” foods. Thus, in order to achieve a considerable reduction in the consumption of meat one approach is to develop meat analogues that compete directly with meat products. Another approach is to introduce protein products that meet the need for more variation and/or new products. The market for meat analogues is still quite small.

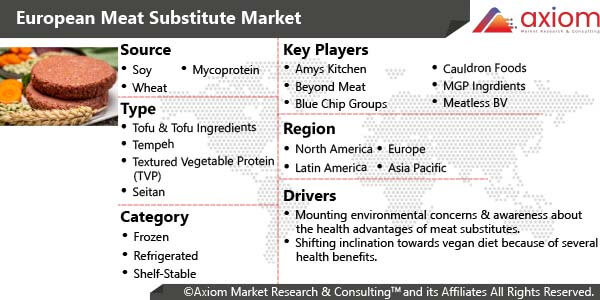

Market Dynamics- European Meat Substitute Market

The major factors driving the European Meat Substitute market are rising environment concern around the world, reduction in meat consumption, growing health concerns, changing dietary pattern, increased preference for vegetarian and vegan foods and limited meat production. However, health concerns surrounding meat alternatives and high cost of meat substitutes are some of the restrains faced by the market.

European Meat Substitute Market-Segmental Overview

The European Meat Substitute market is segmented based on type, source, category, distribution channel and country.

European Meat Substitute Market by Type

The European Meat Substitute market by service is segmented into tofu & tofu ingredients, tempeh, textured vegetable protein, seitan, quorn and others. The demand for tempeh has been increasing in the global market as a competitor of tofu. Tempeh is a better meat alternative of all fermented soy products. Tempeh contains high nutritional value and hence is used in various vegetarian cuisine worldwide, where it is used as meat analogue. Tempeh contains high levels of vitamins B6, B5, B3, and B2. Moreover, it can have many textures and flavors which makes it a better substitute for meat and meat-based products. Tempeh is a healthy food containing probiotic which helps increasing antibodies, build stronger immune system, regulate appetite and reduces sugar. Tempeh is popular in health-conscious consumers as it helps in reducing cholesterol levels naturally. Availability of tempeh in supermarket/ hypermarkets is also driving market for tempeh in urban countries. As a result of growing population of working professionals demand for ready-to-eat tempeh is increasing in urban areas driving market for tempeh globally. Manufacturers are focusing on providing healthier product offerings. Hence, the global tempeh market as a meat substitute is expected to observe robust growth over the forecast period.

European Meat Substitute Market by Source

Meat substitutes are obtained from various sources such as soy, wheat, mycoprotein and others. Other sources of meat substitute include mushrooms, lentils, beans, etc. Among the various source, soy-based meat substitute products accounted for the largest market share, followed by mycoprotein, in 2018. This is because soy protein is a cost-effective and reliable substitute for meat and has the highest amount of protein as compared to other meat substitutes. Soy-based meat substitutes can be produced to mimic the organoleptic characteristics of meat products. Soy burgers, soy turkey, soy bacon, soy chicken, and soy hot dogs are a few popular soy-based food products. Moreover, soy is the most common source of meat substitutes in European. Increasing demand for tofu from food service and beverage manufacturers depicts its popularity. Soy-based products are rich in amino acids, vitamins, fibers, omega-3, and flavones, in addition to being cholesterol-free and low in saturated fat. Soya meat is extremely rich in protein, with a protein content over 50%. Owing to these advantages, soy-based meat substitutes are anticipated to increase their market presence. Soy meat alternatives are closer to the taste and texture of meat, than in the past, because of newer technology. These developments have led to increased demand of these substitutes from the consumers.

European Meat Substitute Market by Category

The various categories by which the European Meat Substitute Market is sectioned includes frozen, refrigerated and shelf-stable. Frozen function segment accounted for the largest market share in 2018. Refrigerated meat substitutes were the second largest market after frozen meat substitutes. Generations view protein differently, with older generations more concerned about the health benefits of protein and younger generations caring about exercise recovery and feeling full.

European Meat Substitute Market by Distribution Channel

The European Meat Substitute Market by distribution channel is segmented into direct and indirect. The indirect distribution channel was the major contributor to the European meat substitute market based on value. Due to various advantages of direct distribution channel such as low cost, limited coverage, time consuming; it was overshadowed by the indirect distribution channel.

European Meat Substitute Market by Country

The various countries studied in this report include Germany, France, United Kingdom, Italy and Rest of the European. The UK’s overarching health trend and the focus on the environmental impacts of meat production have underpinned strong growth in the meat-free foods market in Unites Kingdom. ‘Clean labels’ and greater clarity over the ingredients used are needed to build consumer trust, while innovative products targeting the ‘foodie’ consumer can inject more excitement into the market. The demand for alternative protein beyond traditional meat, fish and dairy sources is expanding across United Kingdom as consumers turn to products they view as healthier and more environment friendly and food makes drives excitement through innovation. Changing consumer habits, and the rise of the flexitarian diet, has led to a trend towards vegetables and meat alternatives. Informa said that the change in eating habits reflects increasing concerns amongst UK consumers around health, animal welfare, and the environmental impact.

European Meat Substitute Market-Key Players

The major players involved in this market are Danisco (DuPont), Amys Kitchen, Cargill, Cauldron Foods, MGP Ingredients, Schouten, Morningstar Farms, Quorn Foods, Sonic Biochem, Vbites Foods and ADM among others.