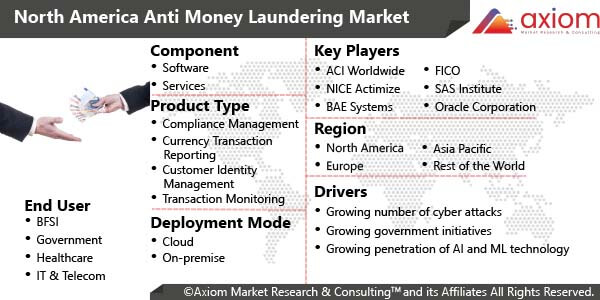

MARKET OVERVIEW- NORTH AMERICA ANTI-MONEY LAUNDERING MARKET

Money laundering activity involves disguising financial assets so they can be used without detection of the illegal activity that produced them. Anti-money laundering (AML) refers to a set of procedures, laws and regulations designed to stop criminals from generating income through illegal actions. An increase in cases of money laundering, presence of a large number of early adopters and a presence of major market players are key factors driving the growth of the market in the region. Also, the implementation of AI, ML in AML solutions, as well as the growing demand for cloud-based AML solutions, is likely to fuel the growth of the market in the region. Also, several companies are focusing on integrating technologies, such as AI, ML, and automation. This is expected to further fuel the growth of the market in the region. Furthermore, technological advancements in the BFSI sector are anticipated to provide lucrative growth opportunities for key players operating in the market.

MARKET DRIVERS

The growth of the Anti-Money Laundering market is driven by rise in cases of money laundering in the North America region. Worldwide, there are between $800 billion and $2 trillion laundered annually. The United States makes up at least $300 billion of that figure, meaning that the U.S. is responsible for 15%-38% of the money laundered annually. Approximately $300 billion is laundered through the United States each year. According to Statistics Canada, there were 2,026 money laundering charges laid across Canada during the five years from 2012-13 to 2016-17. Of those, 1,747 — or 86 per cent — were either withdrawn or stayed, while only 190 — or nine per cent — led to a conviction or guilty plea. According to Statistics Mexico, the number of money laundering offenses brought before Mexican courts increased two-fold between 2018 and 2019. A total of 164 money laundering lawsuits were filled in 2019, compared to the 82 criminal proceedings initiated a year before. Following the same trend, the number of guilty verdicts grew exponentially in the same period, from six convictions in 2018 to 84 in 2019. Thus, the rise in cases of money laundering is a major factor that is anticipated to drive the growth of the , market. Also, several companies are focussing on launching technologically advanced AML solutions. This is expected to further fuel the market growth over the estimated time period.

MARKET OPPORTUNITIES

Several governments as well as private organizations across various countries are focussing on enacting stringent regulations and compliances for AML. For instance, Bank of America has implemented an Anti-Money Laundering (AML) compliance program, which covers all of its subsidiaries and affiliates, and is reasonably designed to comply with applicable laws and regulations. Such stringent regulations and compliances for AML are expected to fuel the market’s growth over the estimated time period. Also, the implementation of key initiatives to promote awareness regarding money laundering is expected to contribute to the growth of the market.

MARKET RESTRAINTS

The complexities involved with AML solutions are limiting the ability of early detection of frauds. This is a major factor which is expected to have a negative impact on the growth of the market.

MARKET GROWTH CHALLENGES

The high cost involved in the deployment of anti-money laundering solutions is expected to challenge the growth of the market. Also, the lack of investments in secure payment systems among the underdeveloped nations is expected to act as a major challenge for the growth of the market.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the North America Anti-Money Laundering market with, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. An increase in cases of money laundering worldwide has led to rise in demand for anti-money laundering solutions, and therefore, the market is expected to witness growth at a specific CAGR from 2023-2029.

NORTH AMERICA ANTI-MONEY LAUNDERING MARKET SEGMENTAL OVERVIEW

North America Anti-Money Laundering market comprises of different market segments like component, organization size, deployment type, vertical, and country.

NORTH AMERICA ANTI-MONEY LAUNDERING MARKET BY COMPONENT

On the basis of component, the North America Anti-Money Laundering market consists of key segments like

The software segment is expected to gain the most market share over the forecast period. AML software helps companies fight financial crime through transaction monitoring to identify any suspicious activity such as terrorist financing and money laundering activities. In addition, it ensures that companies follow anti-money laundering compliance and legal requirements when working with customers and partners to avoid doing business with money laundering entities.

Also, the services segment is expected to register high growth over the forecast period. AML services help prevent a wide variety of money laundering and sanctions related risks for financial institutions.

NORTH AMERICA ANTI-MONEY LAUNDERING MARKET BY ORGANIZATION SIZE

On the organization size, the North America Anti-Money Laundering market consists of key segments like

- Small and Medium-Sized Enterprises

- Large Enterprises

Large enterprises followed by small and medium-sized enterprises segment is expected to hold a large share in the market. Large enterprises were the first to implement AML solutions as they use many business applications that are vulnerable to fraudulent attacks. Large companies with different types of IT infrastructures face the challenge of managing the security of their applications.

NORTH AMERICA ANTI-MONEY LAUNDERING MARKET BY DEPLOYMENT TYPE

By deployment type, the North America Anti-Money Laundering market includes segments like

The on-premise segment is expected to lead the market over the forecast period. On-premises solutions provides organizations complete control over the platforms, applications, systems and data that IT staff can manage. Many organizations use on-premise anti-money laundering solutions to protect them from severe malicious threats.

Also, the cloud segment is expected to witness high growth over the forecast period. Cost-effectiveness provided by cloud-based AML software is a key factor driving the growth of the segment.

NORTH AMERICA ANTI-MONEY LAUNDERING MARKET BY VERTICAL

The North America Anti-Money Laundering market finds key applications across different verticals like

- Banking and financial

- Insurance providers

- Gaming and gambling

- Others

The banking and financial sector is expected to dominate the market over the forecast period. The rise in regulatory measures that banks must consider to prevent and detect financial crime, is expected to stimulate the demand for anti-money laundering solutions.

The insurance providers sector is expected to witness high growth over the forecast period. The rise in focus on preventing money laundering frauds by insurance providers is expected to drive the growth of the segment.

NORTH AMERICA ANTI-MONEY LAUNDERING MARKET BY COUNTRY

The North America Anti-Money Laundering market is studied for the following countries:

- United States

- Canada

- Mexico

United States is expected to dominate the market over the forecast period. The presence of large number of companies providing AML software solutions, compliance management software and others and an increase in focus of financial institutions on digital payment related issues are key factors driving the growth of the market in the region.

Canada is expected to witness high growth over the forecast period. Rise in cases of Money Laundering along with key initiatives implemented by the government to enhance the security of the financial transactions are key factors driving the growth of the market in the country.

COVID-19 IMPACT ANALYSIS ON THE NORTH AMERICA ANTI-MONEY LAUNDERING MARKET

Axiom MRC provides a 360-degree analysis of micro and macro-economic factors with regard to the North America Anti-Money Laundering market. The report involves an exclusive study on COVID-19 impact analysis. In addition, the report also includes a complete analysis of changes in the North America Anti-Money Laundering market, expenditure, and economic and international policies on the supply and demand side. The report also studies the impact of the pandemic on North American economies, international trade, business investments, GDP, and the marketing strategies of key players present in the market.

The COVID-19 has impacted the global economy’s growth. Many organizations remained shut while other scaled down their operations or put their expansion plans on hold as they survived the unpredictable crisis. The outbreak of the COVID-19 pandemic resulted in nationwide lockdowns, and various stringent government regulations on border closing were imposed by the governments of nations across the globe. The pandemic has positively impacted the growth of the market due to a rise in online sales and the increasing use of online payment solutions. The use of digital wallets or e-wallets has also increased. Due to this change, the chances of illegal money transactions have also increased. FATF has warned banks about illegal cash transactions. Because of this, the demand for anti-money laundering solutions has increased. This is expected to drive the demand for anti-money laundering solutions in the upcoming years.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the North America Anti-Money Laundering market is majorly focused on expanding the growth of anti-money laundering industry in North America with new product innovation, and business expansion. The presence of a range of manufacturers operating in anti-money laundering sector has led to the growing demand for the market. Besides, the market offers a range of products in different applications to fulfil the requirements of consumers, which further contributes to healthy growth in the market.

The key players studied in the market are

- BAE Systems (UK)

- Nice Actimize (US)

- FICO (US)

- SAS Institute (US)

- Oracle Corporation (US)

- Experian (Ireland)

- LexisNexis Risk Solution (US)

- Fiserv (US)

- FIS (US)

- Dixtior (Portugal)

- TransUnion (US)

- Wolter’s Kluwer (Netherlands)

- Temenos (Switzerland)

- Nelito Systems (India)

- TCS (India)

- Workfusion (US)

- Napier (UK)

- Quantaverse (US)

- Complyadvantage (UK)

- Acuant (US)

- FeatureSpace (UK)

RECENT DEVELOPMENT:

July 2020: Experian Information Solutions, Inc. entered into a partnership with the Global Data Consortium. The key feature of this partnership was to strengthen customer identity verification by strengthening requirements such as anti-fraud measures, Know Your Customer (KYC), and Anti-Money Laundering (AML). Both the companies benefited from this partnership as it enabled to create a seamless on boarding process and made authenticating a person's identity process easy for many businesses.

January 2019: NICE Actimize launched IFM-X, an integrated fraud management platform that uses machine learning and automation technologies to optimize proficiency while reducing the entire cost of implementing and operating a risk management system.