MARKET OVERVIEW- ASIA PACIFIC CELL COUNTING MARKET

Cell counting is a type of method that is used for the counting or similar quantification of cells in the life sciences, including the medical diagnosis and treatment of chronic diseases such as cancer. Increase in the number of White Blood Cells (WBC) may indicate the possibility of cancerous growth in the body. Cell counting is also important for researchers, and it is one of the major steps in most experiments, which helps in maintaining cell cultures. It is an important procedure that needs to be carried out before any analytical procedures to determine abnormal growth of cells. Furthermore, cell counting is an important step in many experiments done in microbiology, hematology, and other medical specialties.

MARKET DRIVERS

The growing demand for biologics in the treatment of chronic diseases is one of the factors contributing to the market’s growth. Chronic diseases are currently the leading cause of death among adults in several countries of APAC. Infectious diseases are caused by infectious agents, including viruses, bacteria, parasites, fungi, and toxic products. HIV is a major public health issue across APAC. As per The United Nations Programme on HIV/AIDA (UNAIDS), ~37.7 million people had HIV in 2020, 1.7 million were children aged 0-14 years and 36 million were adults. Further, the growing demand for advanced healthcare facilities in emerging economies such as China and collaboration among the market players for the development of innovative products are some other factors that are significantly contributing to the market’s growth. Thus, increasing disease cases and technological development in the region will drive the cell counting market over the forecast period.

MARKET OPPORTUNITIES

The rapid growth of stem cell research in China has been facilitated by increased government funding for scientific research. For example, the Chinese government and the UK government adopted a program related to stem cell research called the UK -China stem cell partnership initiative. Also, the market is expected to have new opportunities with the increased product launches and subsequent increased adoption as a result of technological developments in cell counting equipment and consumables, which have fuelled market expansion.

MARKET RESTRAINTS

A significant restraint on the market is the high cost of cell analysis, which is anticipated to be a barrier to market expansion over the forecast period. Also, the lack of skilled professionals for research and development activities in the underdeveloped countries is expected to hinder the market growth.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of Cell Counting market, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. The rising application scope of cell counting in personalized medicine and high growth in stem cell research have led to an increase in demand for market and is expected to witness growth at a specific CAGR from 2023-2029.

ASIA PACIFIC CELL COUNTING MARKET SEGMENTAL OVERVIEW

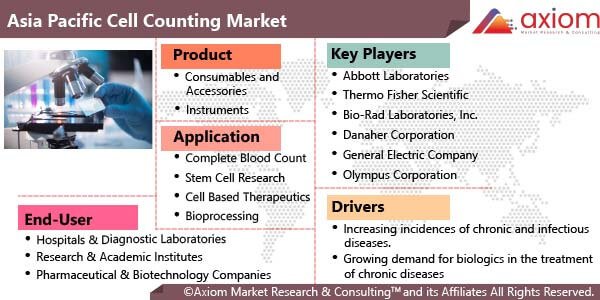

The Asia Pacific Cell Counting market comprises of different market segments like product, application end users and country.

ASIA PACIFIC CELL COUNTING MARKET BY PRODUCT

By product, the Asia Pacific Cell Counting market includes the key segments of

- Consumables and Accessories

- Instruments

The consumable and accessories segment are expected to dominate the market over the forecast period. Consumables and accessories include media, sera, and reagents, assay kits, microplates, accessories and others. Consumables and accessories used with these devices include reagents, microplates, magnetic beads, and chamber slides. The growth of consumables and accessories is attributed to their high usage volume. Moreover, the launch of novel products propels segment growth.

Instruments are expected to grow at a high rate during the estimated time period. Instruments include spectrophotometers, flow cytometers, haemocytometers, automated cell counters, microscopes and others. The increasing usage of cell counters in various applications like research, diagnostics, and industrial. Cell counting instruments are increasingly being adopted in various research areas, such as cancer biology, immunology, and neuroscience, which display exponential growth opportunities for the market segment. Spectrophotometers are further sub-segmented into single-mode readers and multi-mode readers. Hematology analysers are further sub-segmented into fully automated analysers and semi-automated analyse.

ASIA PACIFIC CELL COUNTING MARKET BY APPLICATIONS

By application, the Asia Pacific Cell Counting market includes the key segments of

- Complete Blood Count

- Stem Cell Research

- Cell Based Therapeutics

- Bioprocessing

- Toxicology

- Others

The complete blood count segment is expected to dominate the market over the forecast period. The complete blood count is one of the most commonly used tests to assess a person's general health. The test is used to measure several blood components such as red blood cells, white blood cells, haemoglobin, haematocrit, and platelets. The increasing prevalence of blood disorders such as anaemia and leukemia is expected to fuel the growth of the segment as a complete blood count is commonly used to monitor these disorders.

ASIA PACIFIC CELL COUNTING MARKET BY END USERS

By end-users, the APAC Cell Counting market includes the key segments of

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Pharmaceutical and Biotechnology Companies

- Others

The research and academic institutes are expected to dominate the market over the forecast period. The widespread introduction of cytometers in cell biology research studies. Cytometers are useful for measuring variables like physical traits, type, and lineage that scientists use to track the evolution of viruses, pathogens, and other bacteria. Strategic activities of prominent market players continue to drive the segment forward.

Pharmaceutical and biotechnology companies are expected to grow exponentially over the forecast period. Cell counting is an important aspect of verifying the potency of a biologic. These devices are used to determine the number of cells in a specific culture solution, which is then fed into bioreactors/fermenters to obtain the desired product. The growing demand for biologics produced by bioprocessing in these bioreactors/fermenters is expected to drive the demand for cell counting devices over the projected years.

ASIA PACIFIC CELL COUNTING MARKET BY COUNTRY

The Cell Counting market is studied for the following countries

- India

- China

- Japan

- Rest of Asia Pacific

India is expected to dominate the market over the forecast period. The increasing in the number of diagnostic procedures for various chronic diseases and the rising availability of cost-effective diagnostic test drive the growth of the Asia Pacific cell counting market. Moreover, less complex regulations for drug development in Asian region have boosted the growth of the Asia Pacific Cell counting Market. Further, the growth of the Asia Pacific cell counting market is attributed to the development of medical devices in addition to research and development activities. Moreover, key market players are involved in the export of medical devices by focusing on developing markets to capture a reasonable share in the Asia Pacific cell counting market.

COVID-19 IMPACT ANALYSIS ON ASIA PACIFIC CELL COUNTING MARKET

COVID-19 had a significant impact on the adoption of cell-counting products and consumables. The pandemic witnessed increased adoption of cell counting devices, as osteopenia and lymphopenia were the potential indicators of COVID-19. The study, published in BMC Infectious Diseases in June 2021, found that in COVID-19 patients, a high WBC count upon admission was significantly linked to death. As a result, in the therapy of COVID-19, a higher WBC count should be given more consideration. Thus, the COVID-19 pandemic had a pronounced impact on the growth of the market. However, as the pandemic has subsided currently, the market is expected to experience stable growth over the forecast period of the study.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Asia Pacific cell Counting market is primarily focused on expanding the growth of cell counting through new product innovation, business expansion, increasing presence of a range of manufacturers operating in the cell counting industry has led to growing demand for the market. Besides, the market offers range of products in different application to fulfil the required demand of consumers, which further contributes healthy growth in the market.

The key players studied in market are

- Abbott Laboratories

- Thermo Fisher Scientific

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- General Electric Company

- Olympus Corporation

- Logos Biosystems, Inc.

- Becton, Dickinson and Company

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Siemens Healthcare Private Limited

- Sysmex Corporation

- Tecan Trading AG

- Beckman Coulter Inc

- Corning Incorporated

- Nexcelom Bioscience LLC

- ChemoMetec A/S

- Diconex