MARKET OVERVIEW- GLOBAL SUBMARINE CABLE SYSTEMS MARKET

A Submarine Cable Map is a communication network cable that is laid on a sea bed between land-based stations to carry telecommunication signals across stretches of ocean and sea. Submarine Cable is made of optical fiber cable. These glass fibers are wrapped in layers of plastic (and sometimes steel wire) for protection and carry fiber at extremely rapid rates down thin glass fibers to receptors at the other end of the cable. A cable contains filaments that are about the diameter of a human hair and carry light signals that are extremely thin. The protection from seawater cables needs extra layers of armoring for enhanced protection. These fibers are sheathed in a few layers of insulation and protection. Cable installation has to follow some measures to ensure cables follow the safest path to avoid fault zones, fishing zones, anchoring areas, and other dangers. The undersea cable industry also spends a lot of time educating other marine industries on the location of cables to avoid inadvertent damage. A submarine cable system can be a very expensive and challenging business. The increasing need for data around the globe is the major driving factor for market growth.

MARKET DRIVERS

The ever-increasing data traffic generated by the hyperscale cloud companies and big streaming content providers will drive the demand for extra submarine cables which Satellite systems can’t meet the need alone. With the increasing demand for connectivity and bandwidth still growing globally due to increasing data needs and growing internet users. And these are the reasons why more and more new submarine systems are either being deployed or planned to help satisfy the insatiable demand for greater capacity, scale and reach. By the research report by the telecoms market research and consulting house Tele Geography, Today, more than 450 submarine cables carry about 95% or more, the percentage is contentious around the globe, since 2017, Africa-Europe connectivity has been at about 80% of total potential capacity. In addition, with more than $10bn set to be invested in the 2022-2024 period, it shows that the continuing growth of the subsea cable sector will continue to flourish over time.

MARKET OPPORTUNITIES

The Submarine Cable Systems can be act as source of renewable energy as they use energy from wind turbines or ocean power, they are reducing human dependency on fossil fuels and helping us to move towards a much cleaner energy using society and hence creates the more fruitful opportunities in the coming period. In addition, these cables don't interfere with human matters as they are located way offshore and the cables bring back the energy, they don't interfere with the people on land in ways that a giant power plant, factory, nuclear reactor, or solar/wind farm on land might. They also allow for more of the land to be used for other purposes and create opportunities for other projects. The Submarine Cable Systems allow for energy to be created and distributed in a clean way and have great potential over the forecast period.

MARKET RESTRAINTS

Submarine Cable Systems Market is the restricted by the factor that it can be come with initial high cost of deployment and maintenance costs afterwards will make this business difficult for new companies to enter. The factors such as type of subsea cable and method of cable installation (on or under the seabed) are the two components that most significantly drive the linear subsea cable system cost.

MARKET GROWTH CHALLENGES

The increasing internet demand so does the need for infrastructure to support this growth. Due to issues in supply and chain and increasing demand, there have been major shortages in fiber cables and ODN infrastructure, which have pushed suppliers back 12 to 18 months. In addition, it can be difficult to transport subsea cable components to their intended destination in remote areas. Furthermore, the deployment of subsea fiber optic cable network is very expensive, and finding sources for funding can be a challenge. While building the route, the companies have to deal with rough terrains and extreme weather conditions, making it’s incredibly challenging to install terrestrial and subsea fiber optic cables.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the global Submarine Cable Systems market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. The increasing consumer demand for internet and the growing need for bandwidth for extra data usage will propel the demand for the Submarine Cable Systems Market and is expected to witness a specific CAGR from 2021-2028.

SUBMARINE CABLE SYSTEMS MARKET SEGMENTAL OVERVIEW

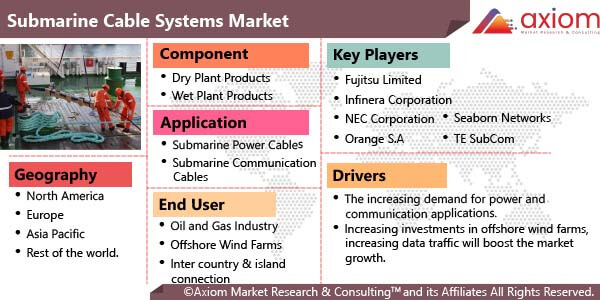

The global Submarine Cable Systems market comprises different market segments like component, application, end user and geography.

SUBMARINE CABLE SYSTEMS MARKET BY COMPONENT

By component, Submarine Cable Systems include key segments of

- Dry Plant Products

- Wet Plant Products

The dry plant products are expected to account for the largest share of the market over the forecast period. The growth of the segment is attributed to cost-effectiveness and recent advancements in the dry plant, such as SDM cables with more fibers and capacity, aluminum conductors, smart cables: emergency alerts for earthquakes and tsunamis, repeater pump farming, virtualized submarine networks, artificial intelligence, and machine learning in submarine systems.

SUBMARINE CABLE SYSTEMS MARKET BY APPLICATION

The Submarine Cable Systems market is divided by application

- Submarine Power Cables

- Submarine Communication Cables

Submarine Communication Cables is expected to account for major market share over the forecast period. These cables – often thousands of miles in length are fiber optic cables that connect countries across the world via cables laid on the ocean floor. These cables are able to transmit huge amounts of data rapidly from one point to another. Private and state-owned telecommunication and technology companies operate about 486 undersea telecommunication cables, which connect every continent except Antarctica and enable consumers, businesses, and governments, including the military, to communicate with each other and to access the internet.

SUBMARINE CABLE SYSTEMS MARKET BY END USER

The Submarine Cable Systems are divided by end user such as

- Oil and Gas Industry

- Offshore Wind Farms

- Inter country & island connection

Offshore Wind Farms accounted for the largest revenue share and is estimated to grow at the highest CAGR during the forecast period. The increasing investments in offshore wind power generation projects and usage of submarine power cables for long-distance power transmissions applications are the primary factor behind the constantly expanding industry size.

SUBMARINE CABLE SYSTEMS MARKET BY GEOGRAPHY

The global Submarine Cable Systems market is studied for the following region

- North America

- Europe

- Asia-Pacific

- Rest of the world (RoW)

Asia-Pacific is expected to dominate the region over the forecast period. The region is also witnessing a rapid increase in mobile broadband penetration and significantly growing adoption of the fibre optic cable market is one of the major factors driving the region’s growth. In Asia Pacific, China is the biggest country in the Asia region. China is one of the leading hubs for various market and the country has signed several deals with potential players such as Google and Facebook to increase internet connectivity across the continents. In addition, the Asian countries are investing heavily to strengthen connectivity through undersea cable networks. For instance, as of August 2021, the Apricot subsea cable will establish a 12,000-kilometer-long cable to connect Japan, Guam, the Philippines, Taiwan, Indonesia, and Singapore. Apricot claims to feature a state-of-the-art configuration allowing flexibility in trunk and branch capacity.

COVID-19 IMPACT ANALYSIS ON THE GLOBAL SUBMARINE CABLE SYSTEMS MARKET

Axiom MRC provides a 360-degree analysis of micro and macro-economic factors in the global Submarine Cable Systems market. In addition, a complete analysis of changes in the global Submarine Cable Systems market expenditure, and economic and international policies on the supply and demand side is provided in this exclusive report. The report also studies the impact of a pandemic on global economies, international trade, business investments, GDP, and the marketing strategies of key players present in the market.

The COVID 19 has caused delay in permits of submarine cable systems and it were already an issue facing the industry in some countries prior to COVID-19. During the COVID, the delays to cable repairs were one of the risks to ensuring global connectivity. The demand for Submarine Cable Systems has surged during COVID as everyone is stuck at home during the coronavirus pandemic, with cinemas and restaurants closed, people have all been spending a lot more of their time online than initially planned at the start of 2020. Covid-19 restrictions are slowing the progress of several global projects. The COVID 19 restrictions have caused conducting site inspections for cable landings and vessel inspections for route surveys have all been impacted The COVID 19 interfered with tasks such as obtaining operational permits, organising meetings with relevant authorities and mobilising resources for cable route surveys and cable lays also take longer and are more complicated than before the pandemic and presents a challenge for the telecoms and internet operators who want these systems expedited and must contend with lower business profitability while waiting for projects to complete.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Submarine Cable Systems market is primarily focused on expanding the global growth of the Submarine Cable Systems industry with new product innovation, business expansion. The increasing presence of a range of manufacturers operating in the Submarine Cable Systems sector has led to the growing demand for the market. Besides, the market offers a range of products in different applications to fulfil the required demand of consumers which is further contributing to healthy growth in the market.

The key players studied in the market are

- Fujitsu Limited

- Huawei Marine Networks Co., Limited

- Infinera Corporation

- NEC Corporation

- Orange S.A

- Norddeutsche Seekabelwerke GmbH

- S. B. Submarine Systems Co., Ltd.

- Seaborn Networks

- TE SubCom

- Xtera Communications, Inc.

- Google LLC

- Amazon.com, Inc.

- Microsoft

- ZTT

- NKT A/S

RECENT DEVELOPMENT:

Jan 2023: Infinera has announced that the company is going to double the capacity of the transpacific Unity Submarine Cable system and its ICE6 800G optical solution has been deployed to the submarine cable, dubbed Unity, which connects the US and Japan, spanning 9,620 kilometers.

July 2022: NEC Corporation has announced that it has been contracted by Seren Juno Network Co., Ltd which is a subsidiary company of NTT Ltd Japan Corporation. Mitsui & Co., Ltd. and JA Mitsui Leasing, Ltd. to build a trans-Pacific subsea fiber-optic cable called JUNO Cable System connecting California in the US with Chiba prefecture and Mie prefecture in Japan.