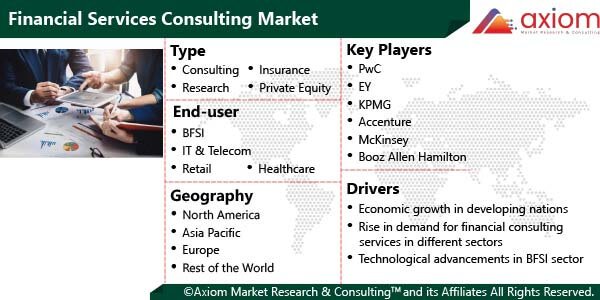

MARKET OVERVIEW- GLOBAL FINANCIAL SERVICES CONSULTING MARKET

A financial consultant helps a business increase shareholder value and improve capital efficiency. Financial consulting companies provide businesses with financial advice in order to improve their financial strategy, create more efficient procedures, and ultimately maximize revenue. These services are provided by certified financial consultants to large corporations, government agencies and individual clients. Financial consultants look at the whole picture of a client’s financial life, including debts, assets, expenses and income, to help clients determine what their goals should be. Increase in demand for financial consulting services due to high economic growth in developing nations is a major factor that is expected to drive growth of the market. Furthermore, the high level of globalization and rise in the number of high-net worth individuals across the globe is anticipated to provide lucrative growth opportunities for key players operating in the market.

MARKET DRIVERS

The high economic growth in developing nations is a major factor driving the growth of the market. According to the UN, Global real GDP per capita was projected to increase by 3 per cent in 2022. The real GDP of the least developed countries is projected to rise by 4.0 per cent in 2022, and 5.7 per cent in 2023. In 2018, most developed economies produced an output per person greater than US$30 000, with economies in Eastern Europe as the main exception. Most developing economies in America, Western, Central and Eastern Asia and in Oceania reached an output higher than US$3 000 per person. Growth remained high, at 5.3 per cent, in developing Asia and Oceania, whereas in the developing economies of America GDP increased by only 0.7 per cent. Thus, high economic growth in developing nations is expected to fuel the demand for financial consulting services in different sectors. Also, the rise in popularity of digital consulting services across the globe is expected to accelerate the growth of the market during the estimated time period.

MARKET OPPORTUNITIES

The rise in awareness about digital financial transactions across the globe is likely to drive the growth of the market. Also, major market players are implementing various strategies such as mergers and acquisitions, partnerships, in order to increase market share and tap the growth opportunities in the market. Also, a rise in high-income individuals in developing nations is expected to have a positive impact on the growth of the market. For instance, according to BizLive, the number of people in the highest bracket, that spend over USD110 every day, is expected to rise from 27m in 2021 to 50m by 2030 and up to 164m by 2040. By then, Asia will have more people in this high-income bracket than either Europe or the U.S Thus, the rise in the number of high-income individuals is expected to boost the demand for financial consulting services in the upcoming years.

MARKET RESTRAINTS

Some financial advisors are bound to make decisions that will benefit the client, but it's not unusual to see conflicts of interest emerge in the case of some advisors. Such situations of conflict of interest in financial consulting and advising is expected to negatively impact the growth of the market. Also, there are many alternatives, available in the online investing market. Tools like Motif Investing and Personal Capital can help you get more comfortable with investing without spending a lot on financial advice. Thus, the presence of alternative solutions is expected to restrain the growth of the market.

MARKET GROWTH CHALLENGES

A high cost associated with financial consulting services is one of the major factors which may negatively impact the growth of the market during the estimated time period. Also, the COVID-19 pandemic is expected to pose a key challenge to the growth of the market.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the global Financial Services Consulting market including, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. High economic growth in developing nations is expected to stimulate the demand for financial consulting services, and therefore, the market is expected to witness growth at a specific CAGR from 2023-2029.

FINANCIAL SERVICES CONSULTING MARKET SEGMENTAL OVERVIEW

Global Financial Services Consulting market comprises of different market segments like type, end-use and geography.

FINANCIAL SERVICES CONSULTING MARKET BY TYPE

On the basis of type, the Financial Services Consulting market consists of segments like

- Consulting

- Research

- Insurance

- Financial Advisory

- Private Equity

- Others

The financial advisory segment is expected to gain the most market share over the forecast period. It includes transaction services, corporate finance, risk management, crisis and recovery, accounting, tax, real estate, litigation etc. A growing number of first-time investors are entering the market with the hopes of putting their assets to work and getting an early start in the investing world. It is expected to drive the demand for financial advisory services.

Also, the insurance segment is expected to witness high growth over the forecast period. To facilitate portfolio expansion, many insurance service providers are developing partnerships with other providers as well as third-party vendors. It is expected to drive the growth of the market.

FINANCIAL SERVICES CONSULTING MARKET BY END-USER

The global Financial Services Consulting market include major end-users like

- BFSI

- IT & Telecom

- Retail and e-commerce

- Healthcare

- Government

- Others

The BFSI (banking and finance industry) is expected to lead the market. The growth of the segment can be attributed to the growing preference for financial advisory services from the BFSI sector, along with the rise in awareness regarding digital consulting services in banking sector.

The retail, and e-commerce segments are expected to witness high growth over the forecast period due to rise in e-commerce sales around the globe. According to Statistica, in 2021, retail e-commerce sales amounted to approximately 5.2 trillion U.S. dollars worldwide. It is expected to grow by 56 percent over the next years, reaching about 8.1 trillion dollars by 2026. Thus, a rise in e-commerce sales is expected to fuel the demand for financial consulting services in the retail, and e-commerce sector.

FINANCIAL SERVICES CONSULTING MARKET BY GEOGRAPHY

The Global Financial Services Consulting market is studied for the following regions:

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

North America is likely to dominate the market over the forecast period. The growth of the market can be attributed to rising demand for financial consultancy services from several industry verticals, along with the presence of key financial consultancy organizations like McKinsey & Company, Deloitte, PricewaterhouseCoopers (PwC), the Boston Consulting Group, Ernst & Young (EY), and KPMG, among others.

The Asia Pacific region is expected to witness the fastest growth over the forecast period. The growth of the market in the region can be attributed to high economic growth in developing nations and the rise in the number of high-net worth individuals across the region. Furthermore, a rise in e-commerce sales is expected to fuel the growth of the market in the region. According to Statistica, the Chinese retail group Alibaba, is the largest e-commerce retailer worldwide, with online sales valued at over 700 billion U.S. dollars in 2022. The fastest growing e-commerce countries based on online sales are the Philippines, and India, where e-commerce sales are forecast to increase by more than 25 percent.

COVID-19 IMPACT ANALYSIS ON THE GLOBAL FINANCIAL SERVICES CONSULTING MARKET

Axiom MRC provides a 360-degree analysis of micro and macro-economic factors with regard to the Financial Services Consulting market. The report involves an exclusive study on COVID-19 impact analysis. In addition, the report also includes a complete analysis of changes in the global Financial Services Consulting market, expenditure, and economic and international policies on the supply, and demand side. The report also studies the impact of pandemics on global economies, international trade, business investments, GDP, and the marketing strategies of key players present in the market.

The COVID-19 pandemic has had a negative impact on the global economy. From the travel industry to small enterprises all businesses lost significant revenue due to government-imposed lockdown restrictions. According to Consultancy.org, the global consulting industry could lose up to $30 billion in revenue in 2020. Also, the pandemic has pushed the clients delaying their projects as well as cancelling future plans. This became a serious concern for the financial consulting services industry as it directly affected the revenues of financial consultants. However, since the outbreak of the pandemic, remote working has gained tremendous popularity, as financial consultants need to work from different parts of the world for their projects. This is expected to provide lucrative growth opportunities for key players in the market during the estimated time period.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Financial Services Consulting market is majorly focused on expanding the global growth of the financial consulting services industry with new product innovation, and business expansion. An increasing presence of a range of manufacturers operating in financial consulting services sector has led to growing demand for the market. besides, the market offers a range of services in different applications to fulfil the requirements of consumers, which further contributes to healthy growth in the market.

The key players studied in the market are

- PwC

- Deloitte Consulting

- EY

- KPMG

- Accenture

- Barkawi Management Consultants

- McKinsey

- Booz Allen Hamilton

- Boston Consulting Group

- Bain & Company

- Ramboll Group

- Capgemini SE

- Simon-Kucher & Partners

- Wells Fargo & Co.

RECENT DEVELOPMENT:

August 2022: PwC India completed the acquisition of Venerate Solutions Private Limited, a salesforce consulting firms in India. This acquisition of Venerate's technical expertise will enhance and complement existing Salesforce consulting capabilities. It is expected to solve clients' most critical problems by delivering human-led and tech-powered solutions.

January 2021: JCW Group launched a financial services consultancy, Guideline, to provide regulatory consulting to clients in the financial services sector. The Guideline will provide strategic advice and leverage its parent company's staff augmentation network and expertise.