MARKET OVERVIEW - GLOBAL SATELLITE COMMUNICATION MARKET

Satellite communications are well beyond this distance barrier. Satellite communication is being used for a plethora of applications across industries, such as media broadcasting, an extension of broadband coverage, the setting up of 5G communications systems, integration, and convergence of diverse wired and wireless technologies, earth observation, defense and security, and surveillance applications. Satellite communications services provide secure bandwidth capacity that is considered ideal for military operations conducted in remote areas with inadequate and unreliable communications infrastructure. Advantages of satellite communications include greater spatial coverage than terrestrial systems, long range coverage to every corner of the world, increased bandwidth and transmission capacity, and the ability to adjust associated communications costs based on coverage area.

MARKET DRIVERS

The rising integration of the Internet of Things in various industries is likely to drive the satellite communication market. Technological development of small satellites in ground operations has increased the demand for the product. Also, satellite communications (Satcom), have become an integral part of modern communications infrastructure, including satellites in networks, which is boosting market growth. Besides, the growing demand for data analytics, cloud computing, and artificial intelligence will boost demand for the product.

MARKET OPPORTUNITY

Changes in satellite communications and advances in telecommunications and computing processes of all kinds have created new opportunities for innovation in this field. Further, the growing trend of adopting autonomous systems and connected devices in the industrial sector is positively influencing the market studied. According to Ericsson, the number of massive IoT connections is expected to have doubled, reaching close to 200 million connections. According to Ericsson, by the end of 2027, 40% of cellular IoT connections will be broadband IoT, with 4G connecting the majority.

MARKET RESTRAINT

On the other hand, security concerns regarding the sustainability of satellite systems may hamper the growth of the satellite communications (SATCOM) market.

MARKET GROWTH CHALLENGES

The COVID-19 pandemic hampered the growth of the market to a major extent, which has created a major challenge for market growth. Also, the cost, technological dependence and lack of skilled labor are some of the major obstacles for the satellite communication market.

CUMULATIVE GROWTH ANALYSIS

The report providesan in-depth analysis of the satellite communication market, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. The growing trend of deploying autonomous systems and connected devices in the industrial sector across the globe is fueling the growth of the market and is expected to witness are growth at a CAGR at a specific CAGR from 2023-2029.

GLOBAL SATELLITE COMMUNICATION MARKET SEGMENTAL OVERVIEW

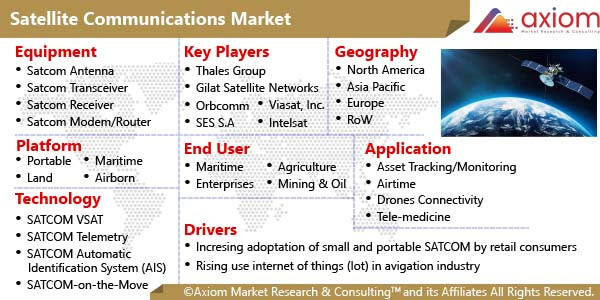

The satellite communication market comprises of different market segment like equipment, platform, technology, application, end-user and geography.

GLOBAL SATELLITE COMMUNICATION MARKET BY EQUIPMENT

By equipment, the satellite communication includes key segment of

- Satcom Transmitter/Transponder

- Satcom Antenna

- Satcom Transceiver

- Satcom Receiver

- Satcom Modem/Router

The satcom transceiver segment is expected to lead the market over the forecast period. Increasing demand for transcontinental coverage across networks is driving the growth of the satellite communications transceiver market. The growth is also due to the rising replacement of transmitters and receivers with advanced transceiver systems. Satcom equipment is primarily used in weather surveillance, military surveillance, navigation and telecommunications. Adding to that, the increasing number of satellite broadcasts for applications such as remote sensing and agricultural monitoring is expected to boost the segment’s growth. For instance, in the year 2018, one of India’s leading space research institutes announced that it would upgrade its remote sensing satellites to increase the number of crops covered by India’s space-based agricultural forecast from the current eight to more than 20. Furthermore, the satellite communication antenna is expected to be the fastest-growing segment in the satellite communication market.

GLOBAL SATELLITE COMMUNICATION MARKET BY PLATFORM

By platform, the satellite communication includes key segment of

- Portable

- Land

- Maritime

- Airborn

The airborne satcome is expected to dominate the market over the forecast period. The growing need for high-definition news, surveillance, and reconnaissance (ISR) video, an increasing number of connected commercial aircraft, increasing adoption of UAVs, and there is growing number of private aviation organizations around the world supporting the growth of the market. The growing use of airborn satcom in military, aircraft and commercial aircraft, unnamed aerial vehicles, and satellite launch vehicles. On the other hand, the maritime satcome is expected to be the fastest-growing segment due to the growing adoption of autonomous and connected ships, which is expected to boost the segment’s growth.

GLOBAL SATELLITE COMMUNICATION MARKET BY TECHNOLOGY

By technology, the satellite communication includes key segment of

- SATCOM VSAT

- SATCOM Telemetry

- SATCOM Automatic Identification System

- SATCOM-On-The-Move

- SATCOM-On-The-Pause

The SATCOM VSAT is expected to dominate the market over the forecast period. A Very Small Aperture Terminal (VSAT) is a small earth station used to send and receive data, voice, and video signals over non-broadcast satellite communications networks. VSAT consists of two parts: A transceiver placed outdoors with a direct view of the satellite and a device placed indoors to connect the transceiver to the end user’s communications device, such as a PC.

GLOBAL SATELLITE COMMUNICATION MARKET BY APPLICATION

By application, the satellite communication includes key segment of

- Asset Tracking/Monitoring

- Airtime

- Drones Connectivity

- Data Backup and Recovery

- Navigation and Monitoring

- Tele-medicine

- Broadcasting

Broadcasting is expected to dominate the market over the forecast period. Increasing demand for satellite communications for radio and pay-TV applications is impacting the growth of the broadcasting segment. Satellite communications can provide seamless connectivity in remote and remote locations. However, increasing adoption of over-the-top (OTT) services is likely to hinder market growth during the forecast period.

GLOBAL SATELLITE COMMUNICATION MARKET BY END-USER

By end-user, the satellite communication includes key segment of

- Maritime

- Defense and government

- Enterprises

- Media and Entertainment

- Agriculture

- Mining and Oil

- Corporate Enterprises

- Communication Companies

- Others

The defence and government are expected to dominate the market over the forecast period. Satellite communications services are increasingly being used by the Navy and Defense Forces to establish or enhance connectivity at various military installations, including combat aircraft. Additionally, the developing market for unmanned aerial systems and their increasing non-military applications are driving the growth of satellite communication systems.

GLOBAL SATELLITE COMMUNICATION MARKET BY GEOGRAPHY

By geography, the satellite communication includes key segment of

- North America

- Asia Pacific

- Europe

- RoW

The North America region is expected to dominate the satellite communication market over the projected time period due to an increased demand for continued communications by the defense industry and increased demand for SATCOM equipment by the US Department of Defense. In 2020, the North American satellite communications market accounted for 35.0% share. Many satellite communication providers such as Telesat, Viasat, Inc., EchoStar Corporation are also contributing to the market growth. Further, the regional market is expected to expand significantly in the coming years due to the modernization of military communication infrastructure. Moreover, government agencies in North America have made great efforts to introduce new satellite and navigation systems that have fueled the growth of the satellite communications industry. North America has vast coastal areas that require constant surveillance. Increased commercial activity and trade in the region have increased the need for maritime security and surveillance. All these factors are expected to boost the satellite communication market’s growth in North America.

The Asia Pacific is expected to be the fastest-growing region. Due to the expansion of this region, it is mainly countries such as China and Japan. The increasing use of satellite antennas in telecommunications, aerospace, IT, and automotive industries drives the growth of the regional market throughout the forecast period.

COVID-19 IMPACT ANALYSIS ON GLOBAL SATELLITE COMMUNICATION MARKET

The recent COVID-19 outbreak in Wuhan, China, has now evolved into a public health event of international concern. Conventional public health interventions are less effective without antiviral drugs and vaccines. The COVID-19 pandemic disturbed economies across the globe as well as adversely affected the development of different enterprises like oil and gas, construction, manufacturing, and others. The manufacturers of satellite communication systems and components have also been impacted. Resuming manufacturing activities depends on the level of COVID-19 exposure, the level at which manufacturing operations are running. Although there is a slight decline in market growth, it is expected to boost the satellite communication market.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the satellite communication market is primarily focused on expanding the global growth of the satellite communication market through new product innovation, business expansion, and the increasing presence of a range of manufacturers operating in the market has led to growing demand for the market. Besides, the market offers a range of products to fulfil the required demand of consumers, which is further contributing to healthy growth in the market.

The key players studied in market are

- Thales Group

- Inmarsat Communications

- Iridium Communications Inc.

- Gilat Satellite Networks

- Orbcomm

- SES S.A

- Viasat, Inc.

- Intelsat

- Telesat

- EchoStar Corporation

- L3 Technologies, Inc

RECENT DEVLOPMENT

FEBRUARY 2022: Thuraya Telecommunications Company has announced a new IP-based wireless communications solution, Thuraya Push-to-Talk (PTT). This product was developed in conjunction with Cobham SATCOM, a provider of satellite communications solutions for the marine and land markets. This solution will enable users in a wide range of industries to extend the reach of their voice communications beyond line of sight (BLOS).

February 2022: Telesat and Cobham SATCOM have announced a contract to deploy high performance Cobham SATCOM 3-axis TRACKER 4000 terminals for the Telesat Lightspeed Landing Station network. Under the terms of the contract, Cobham SATCOM will manufacture, integrate and install advanced Ka-band tracking antennas at Telesat sites around the world.

MAY 2022: UltiSat Inc. and Cobham Satcom announced that they have signed a strategic distributor and integrator agreement to expand their market reach.