MARKET OVERVIEW- GLOBAL RARE DISEASES TREATMENT MARKET

The growing prevalence of rare diseases and their impact on healthcare spending have increased the demand for special treatments, which has had a positive impact on the growth of the rare disease treatment market. The growing focus on research and development of new therapeutic drugs has increased the market value for the treatment of rare diseases. Furthermore, increasing product developments are leading to the implementation of innovative, technologically driven devices for the diagnosis of rare genetic diseases. Additionally, favourable government policies aimed at raising awareness about rare disease treatment are leading to greater acceptance of effective treatments for rare diseases. Also, the growing preference for minimally invasive surgical procedures for the treatment of rare and chronic diseases is a key factor that is anticipated to provide ample new growth opportunities for the market in the upcoming years.

MARKET DRIVERS

The rise in rare disease cases has encouraged key players to develop new and advanced treatments, which is expected to drive the growth of the market in the coming years. Favourable government rules and regulations and people's growing preference for healthy lifestyles are some of the key factors that should develop the global rare disease treatment market over the forecast period. The market is expected to experience healthy growth in the coming years due to the increase in the geriatric population and the growing focus of players on improving medical facilities is likely to boost market growth in the near future.

The presence of a strong product pipeline and upcoming launches are expected to fuel market growth. According to Pharmaceutical Research and Manufacturers of America, in 2022 there were approximately 791 potential drug candidates in clinical trials for rare diseases, 56 for neurological diseases, 54 for blood diseases, 51 for autoimmune diseases and 36 for infectious diseases. Additionally, around 26 new drugs for orphan diseases were approved by the Center for Drug Evaluation and Research (CDER) in 2022. Some of the approved products were Lumakras, Scemblix, Welireg, Amondys 4, Bylvay, Welireg, Cytalux, Besremi, Empaveli, Evkeeza, Exkivity, Fexinidazole, and Zynlonta, among others. Therefore, the growing approval and launch of new orphan drugs is expected to drive the growth of the industry.

MARKET OPPORTUNITIES

The increasing emphasis on research activities and the development of new therapeutic drugs has increased the market value of the treatment of rare diseases. Additionally, increasing product developments are leading to the implementation of innovative technology-driven devices to diagnose rare genetic diseases. In addition, supportive government policies aimed at raising awareness of rare disease treatment lead to increasing acceptance of effective rare disease treatments. Besides, emerging features and new technologies for efficient treatment are a key factor that is expected to provide new growth opportunities for the market over the forecast period.

MARKET RESTRAINTS

Market growth can be hindered by the high costs relating to the research and development of pipeline candidates used for the treatment of rare diseases, which in turn contribute to the increase in drug prices. This can be attributed to factors such as the capital increase for the conduct of clinical trials through contract research organizations (CRO) and the risk of pharmacological failure during these clinical trial programs.

MARKET GROWTH CHALLENGES

There are several factors that hinder efficient and effective clinical trials of drug development for rare diseases, including low patient numbers, limited understanding of disease and progression, and lack of established endpoints. Therefore, several regulatory bodies are implementing regulatory standards for drug approval for rare diseases to ensure patient safety and drug efficacy. Also, a lack of skilled professionals is expected to be a major challenge for the market’s growth over the forecast period.

CUMULATIVE GROWTH ANALYSIS

The report provides in-depth analysis of the global Rare Diseases Treatment market, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. With increasing demand for various Rare Diseases Treatment in various applications has led the increasing demand for market and is expected to witness the growth at a CAGR at specific CAGR from 2023-2029.

RARE DISEASES TREATMENT MARKET SEGMENTAL OVERVIEW

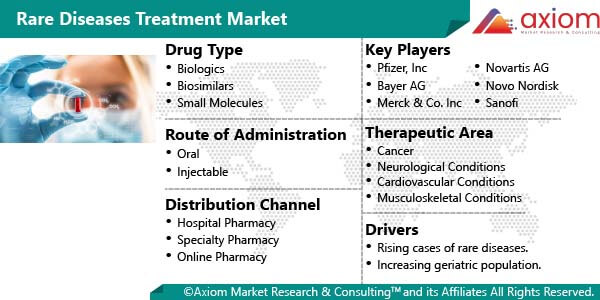

The global Rare Diseases Treatment market comprises different market segments like drug type, route of administration, distribution channel, therapeutic area and geography.

RARE DISEASES TREATMENT MARKET BY DRUG TYPE

By drug type, the Rare Diseases Treatment market includes the key segments of

- Biologics

- Biosimilars

- Small Molecules

The biologics segment is expected to dominate the market over the forecast period. Advances in biotechnology and research techniques have facilitated the development of new biologics. The high target specificity and potential of biologic drugs revolutionizing the treatment of several rare diseases is expected to drive the segment's growth.

Biosimilars are expected to grow at a high rate over the forecast period. The emergence of biosimilars for the treatment of rare diseases has proven a breakthrough for patients. The expiration of patents on orphan drugs and supporting regulatory policies will pave the way for new players to enter the market and increase competition, leading to a reduction in the price of drugs used to treat several rare diseases, thus stimulating the growth of the segment.

RARE DISEASES TREATMENT MARKET BY ROUTE OF ADMINISTRATION

By route of administration, the Rare Diseases Treatment market is segmented into

The injectable segment is expected to witness significant growth over the forecast period. This is due to the introduction of new injectables to treat rare diseases.

The oral segment is expected to hold a significant market share in the treatment of rare diseases. The significant market share is due to numerous advantages, such as safety, good adherence to treatment, ease of administration and no risk of pain with the oral route. In addition, the scientists developed an oral drug, Migalastat, to treat patients with Fabry disease, a rare genetic disorder, and it has been shown to be effective in treating the disease. Therefore, increased awareness of the efficacy of such drugs has led to greater acceptance of the oral route of administration in the treatment of rare diseases.

RARE DISEASES TREATMENT MARKET BY DISTRIBUTION CHANNEL

The Rare Diseases Treatment market has distribution channels like

- Hospital Pharmacy

- Specialty Pharmacy

- Online Pharmacy

The specialty pharmacies segment is expected to dominate the market. This dominance is attributed to the strategic initiatives of major players such as: B. the acquisition of specialty pharmacies for the distribution of their products. For example, in December 2020, Centene acquired PANTHERx, the largest specialty pharmacy in the United States engaged in the distribution of expensive orphan drugs used to treat various types of rare diseases. Centene serves as an intermediary for government and privately funded health insurance programs. These acquisitions are expected to drive the growth of the segment over the forecast period. Based on distribution channels, the global market is further segmented in a hospital pharmacy, specialty pharmacy and online pharmacy.

Hospital pharmacy is expected to be the fastest growing segment during the projected time period. This can be attributed to the high hospitalization of SMA. The majority of patients are treated in hospitals due to the high risk of breathing problems and scoliosis. According to the Orphanet Journal of Rare Diseases (2020), the intramural ratio was the highest in paediatric patients from 0 to 4 years.

RARE DISEASES TREATMENT MARKET BY THERAPEUTIC AREA

By therapeutic area, the Rare Diseases Treatment market is segmented into

- Cancer

- Neurological Conditions

- Cardiovascular Conditions

- Musculoskeletal Conditions

- Hematologic Disorders

- Infectious Diseases

- Metabolic disorders

- Endocrine disorders

- Others

Cancer segment is expected to dominate the market during the estimated time period. This predominance is due to the high prevalence and recurrence rate of rare cancer indications. According to the American Cancer Society, the estimated incidence of oesophageal cancer, chronic myeloid leukemia, and anal cancer in the United States in 2022 was 19,260, 9,110, and 9,090, respectively. Based on therapeutic area, the global market is segmented into cancer, neurological disorders, cardiovascular disorders, musculoskeletal disorders, hematological disorders, infectious diseases, metabolic disorders, endocrine disorders, and others.

Musculoskeletal disorders are expected to be the fastest growing segment over the forecast period, owing to the increasing prevalence of this condition and the approval of new products for its treatment.

RARE DISEASES TREATMENT MARKET BY GEOGRAPHY

The global Rare Diseases Treatment market is studied for the following regions

- North America

- Europe

- Asia-Pacific

- Rest of the world (RoW)

North America is expected to maintain its dominance during the forecast period. The presence of a large number of top players and top healthcare institutions are some of the major factors that are expected to fuel the growth of the market in the near future. Additionally, growing reimbursement policies for arranging treatment for rare disease patients are expected to accelerate the growth of the market in North America in the coming years.

Asia-Pacific is expected to be the fastest growing region during the forecast period. The growth of the region can be attributed to initiatives taken by governments to support orphan patients. For example, in July 2023, the Indian government requested that national and state governments ensure the effective implementation of health policies developed for the treatment of patients suffering from orphan diseases. This measure creates an opportunity for manufacturers to provide high quality orphan drugs to the government and generate revenue.

COVID-19 IMPACT ANALYSIS ON GLOBAL RARE DISEASES TREATMENT MARKET

Axiom MRC provides a 360 degree analysis of micro and macro-economic factors on the global Rare Diseases Treatment market. In addition, a complete analysis of changes in the global Rare Diseases Treatment market expenditure, economic and international policies on the supply and demand side is provided in this exclusive report. The report also studies the impact of pandemic the on global economies, international trade, business investments, GDP and marketing strategies of key players present in the market.

The COVID-19 pandemic is an unprecedented public health issue and has presented researchers, healthcare professionals, and patients with multiple challenges. R&D facilities and the biopharmaceutical industry cannot focus on developing new therapies due to the threat of exposure to the coronavirus. According to a COVID-19 community survey report from the National Organization for Rare Disorders (NORD), approximately 74% of rare disease patients in the United States have difficulty accessing quality medications. Therefore, to address these difficulties, the FDA is proactively working with manufacturers to provide advanced treatments to ensure continuity of patient care with a focus on continued clinical trials. Several biopharmaceutical companies are also focusing on drug development to meet the demand for treatment of rare diseases. Therefore, during the pandemic, drugs used for the treatment of rare diseases develop slowly, which is expected to limit the expansion of the market.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of Rare Diseases Treatment market is primarily focused on expanding the global growth of the rare diseases treatment sector with new product innovation, business expansion, increasing presence of a range of key players operating in the rare diseases treatment sector has led to growing demand for the market. Besides, the market offers a range of treatments in different applications to fulfil the required demand of consumers, which is further contributing healthy growth in the market.

The key players studied in market are

- Pfizer, Inc

- Bayer AG

- Actelion Pharmaceuticals Ltd

- Johnson & Johnson Services, Inc

- Celgene Corporation

- Merck & Co. Inc

- Novartis AG

- F. Hoffmann-La Roche Ltd

- Novo Nordisk

- Sanofi

- AbbVie Inc

- Bristol Myers Squibb

- Baxter

- Eisai Co. Ltd

- Vertex Pharmaceuticals

- Teva Pharmaceutical Industries Ltd

RECENT DEVELOPMENT:

July 2023: Pfizer Inc. had received approval for Xalkori (crizotinib) by the U.S. FDA for the treatment of pediatric and adult patients with ALK-positive inflammatory myofibroblastic tumor (IMT). The recommended dose in adult patients is 250 mg and is to be administered orally twice daily until disease progression stops.

February 2022: The U.S. FDA approved Sarepta Therapeutics’ AMONDYS 45 (casimersen injection) for the treatment of Duchenne muscular dystrophy (DMD).