MARKET OVERVIEW- GLOBAL CELL COUNTING MARKET

Cell counting is a method of counting for medical applications and plays an important role in research and clinical activities. The number of cells in liquid media is expressed in cells per unit of volume or concentration. Numerous treatment procedures require cell counting to perform further procedures. For example, the concentration of red blood cells or while the blood cells provide essential information about a patient's health status. In research activities, cell counts determine the amount of reagents and chemicals to add to a solution. Improvements in healthcare infrastructure are opening up new avenues in the cell counting market. This factor is anticipated to provide ample new growth opportunities for the market in the upcoming years.

MARKET DRIVERS

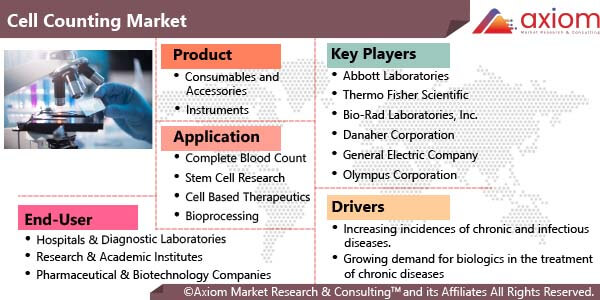

The increased prevalence of chronic and infectious diseases is expected to be a major factor which would help intensify the growth of the Cell Counting Market. The rise in capital for cell-based research, the rise of the biotech and biopharmaceutical industries, the expansion of improved solutions and the improvement of image analysis, the growing practice of flow cytometry at high throughput and the use of flow and mechanical haematology analyzers are factors that is anticipated to drive the growth of the Cell Counting Market over the forecast period. The growing demand for biologics for the treatment of chronic diseases is one of the factors contributing to market growth. Biologics development involves the use of various cell counting products, such as flow cytometers and spectrophotometers, which control cell concentration in biologics, boosting the growth prospects for this market. On the other side, rapid economic development in the developing countries has led to a tremendous improvement in cell-based research which is expected to further boost the market’s growth during the estimated time period.

MARKET OPPORTUNITIES

Cell counting instruments are gradually being applied in numerous research areas, such as neuroscience cancer biology and immunology, providing profitable growth opportunities for the market. Furthermore, technological developments in these devices will present profitable opportunities in the projected time period. The market is also expected to see exponential growth as blood cell counting is necessary for the assessment of various diseases, and its adoption is expected to increase over the forecast period. In addition, they are widely used in cancer research to regulate intra-tumor heterogeneity, which is essential for the determination of cancer progression. These are anticipated to be key growth prospects for the market in the upcoming years.

MARKET RESTRAINTS

The market has a major restraining factor like the high cost of cell analysis and this factor is expected to acts as a hurdler for the market growth over the forecast period. Besides, lack of skilled professionals for research and development activities in the underdeveloped nations is another factor which is expected to restrain the market’s growth during the projected time period.

MARKET GROWTH CHALLENGES

Counting cells using a haemocytometer has a number of shortcomings. These deficiencies include, but are not limited to, a lack of statistical robustness at low sample concentration, poor counts due to device misuse, and subjectivity of counts among users. Also, reluctance among researchers to use advanced cell counting techniques is expected to be a major challenge for the market growth over the forecast period.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of global Cell Counting market, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. With increasing demand for cell counting instruments in various applications has led the increasing demand for market and is expected to witness the growth at a specific CAGR from 2023-2029.

CELL COUNTING MARKET SEGMENTAL OVERVIEW

The global Cell Counting market comprises different market segments like machine type, mode of operation, distribution channel, end users and geography.

CELL COUNTING MARKET BY PRODUCT

By product, the Cell Counting market includes the key segments of

- Consumables and Accessories

- Instruments

Consumables and accessories includes media, sera, and reagents, assay kits, microplates, accessories and others. Instruments includes spectrophotometers, flow cytometers, haemocytometers, automated cell counters, microscopes and others. Consumables and accessories segment is expected to dominate the market over the forecast period. The growth in consumables and accessories is attributed to their high volume of use. In addition, the launch of new products is driving the growth of the segment. The reagents sub-segment is expected to have large growth over the forecast period. This is attributed to the repeat purchase of these products for use in spectrophotometry, flow cytometry and automated cell counting. The need for frequent recalibration of these instruments before conducting experiments increases their demand.

Also, the instruments segment is expected to grow at a high rate as the use of various cell counting instruments, such as flow cytometers and spectrophotometers, which control cell concentration are used in biologics, boosting the growth prospects for this segment.

CELL COUNTING MARKET BY APPLICATIONS

The Cell Counting market has key applications in

- Complete Blood Count

- Stem Cell Research

- Cell Based Therapeutics

- Bioprocessing

- Toxicology

- Others

Complete blood count is further segmented into automated cell counters and manual cell counters. Complete blood count is expected to dominate the market over the forecast period. The complete blood count is one of the most commonly used tests to assess a person's general health. The test is used to measure several blood components such as red blood cells, white blood cells, haemoglobin, haematocrit, and platelets. The increasing prevalence of blood disorders such as anaemia and leukemia is expected to fuel the growth of the segment as a complete blood count is commonly used to monitor these disorders.

Stem cell research is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is the result of the growing need to mass-produce human stem cells for clinical and research applications. Stem cells are of paramount importance in fields such as regenerative medicine, cancer treatment and transplantation. Automated devices facilitate the accurate determination of stem cell viability and nucleated cell concentration in umbilical cord blood or human bone marrow. Additionally, features such as fluorescence imaging are increasingly being used to quantify the efficiency of green fluorescent protein (GFP) for transfection in stem cell applications.

CELL COUNTING MARKET BY END USERS

The Cell Counting market has major end users like

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Pharmaceutical and Biotechnology Companies

- Others

Research and academic institutes are expected to have the largest growth over the forecast period. The dominant proportion is due to the widespread introduction of cytometers in cell biology research studies. Cytometers find application in measuring parameters such as physical characteristics, type, and lineage used by researchers to study the progression of viruses, pathogens, and other bacteria. Strategic activities of prominent market players continue to drive the segment forward.

Pharmaceutical and biotechnology companies are expected to grow exponentially over the forecast period. Cell counting is an important aspect of verifying the potency of a biologic. These devices are used to determine the number of cells in a specific culture solution, which is then fed into bioreactors/fermenters to obtain the desired product. The growing demand for biologics produced by bioprocessing in these bioreactors/fermenters is expected to drive the demand for cell counting devices over the projected years.

CELL COUNTING MARKET BY GEOGRAPHY

The global Cell Counting market is studied for the following regions

- North America

- Europe

- Asia-Pacific

- Rest of the world (RoW)

North America is expected to dominate the market due to an increase in cancer incidence, presence of well-established pharmaceutical and biotech industry, the availability of technologically advanced products and government support important in the form of funds and subsidies.

Asia-Pacific is expected to grow exponentially throughout the forecast period. This exponential growth can be attributed to the local presence of some clinical research and biopharmaceutical companies in this region. Additionally, the growing geriatric population, which is highly susceptible to chronic diseases, is driving the market in the region. This has led to an unprecedented increase in the acceptance of these devices, as the number of clinical trials conducted each year for geriatric patients has increased.

COVID-19 IMPACT ANALYSIS ON GLOBAL CELL COUNTING MARKET

Axiom MRC provides a 360 degree analysis of micro and macro-economic factors on the global Cell Counting market. In addition, a complete analysis of changes on the global Cell Counting market expenditure, economic and international policies on the supply and demand side is provided in this report. The report also studies the impact of pandemic on global economies, international trade, business investments, GDP and the marketing strategies of key players present in the market.

COVID-19 has had a significant impact on the growth of the market. During the pandemic, there was a significant increase in the use of cell counters as lymphopenia and eosinopenia were the potential indicators of COVID-19. Additionally, the study, published by BMC in June 2022, concluded that the COVID-19 patient's white blood cell count on admission is significantly correlated with patient deaths. When treating COVID-19, attention should be paid to a higher white blood cell count. The rising importance of cell count in patients with COVID-19 has fuelled the growth of the market during the pandemic.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of Cell Counting market is majorly focused on expanding the global growth of cell counting through new product innovation, business expansion, increasing presence of a range of manufacturers operating in the cell counting industry has led to growing demand for the market. Besides, the market offers a range of products in different applications to fulfil the required demand of consumers, which is further contributing to healthy growth in the market.

The key players studied in market are

- Abbott Laboratories

- Thermo Fisher Scientific

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- General Electric Company

- Olympus Corporation

- Logos Biosystems, Inc.

- Becton, Dickinson and Company

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Siemens Healthcare Private Limited

- Sysmex Corporation

- Tecan Trading AG

- Beckman Coulter Inc

- Corning Incorporated

- Nexcelom Bioscience LLC

- ChemoMetec A/S

- Diconex

RECENT DEVELOPMENT:

April 2022: CytoSMART Technologies launched automated CytoSMART Exact FL, the company’s first fluorescence cell counter. It is a dual fluorescence device and is used for typical laboratory applications.

June 2020: DeNovix launched the first in-the-market imaging cell counter, which eradicates the requirement for slides, thus reducing the environmental footprint of the laboratory.