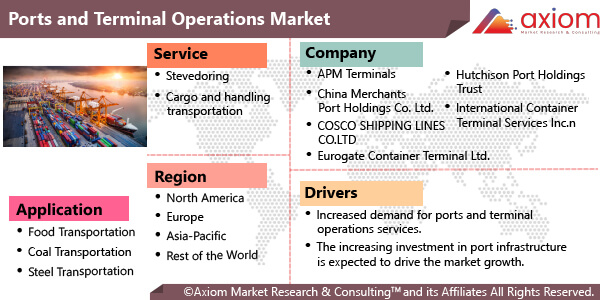

MARKET OVERVIEW- GLOBAL PORTS AND TERMINAL OPERATIONS MARKET

Ports and Terminal Operations are the different type of maritime services which are performed at the port terminal. These services include cargo handling, storage, transhipment, and cargo delivery services to vessels, as well as related services. It is also called as a multifunctional entity where various specialized terminal activities are performed which deals with specific goods and commodities such as containers, grain, oil, or iron ore. These services are often associated with the combination of terminal activities that are intended for a single user such as a petrochemical plant. A port is a virtual point where network connections begin and come to an end. With the help of a software-based system, every port is interconnected to a particular process or service. A port terminal is related to a specific range of equipment which requires a footprint and a configuration. For an instance, oil terminal can only handle crude oil bulk shipment through specialized equipment and storage facilities. The rapid growth and expansion of maritime logistics services, along with advantages offered by sea freight services like large cargo space availability, cost-effectiveness, and safety, are major factors which are expected to drive growth of the market.

MARKET DRIVERS

The increasing port trade and the expansion of

maritime logistics services. UNCTAD in its flagship "Review of Maritime Transport 2022" has called for increased investment in maritime supply chains. The Maritime India Vision-2030, a 10-year blueprint with the aim of overhauling the Indian maritime sector, envisages Rs 3 lakh crore investment in port projects that in turn promises to generate employment for 20 lakh persons. An increasing globalization of manufacturing and outsourcing of goods all over the world as well as an increasing volume of containers and world seaborne freight are expected to drive the market growth. In addition, ports are important for economic growth in coastal areas. Ports also offer the crucial connection between sea and land transport, which is economically crucial. These factors have significantly increases the importance of port and terminal services. Also, several governments across various countries are focusing on promoting port operations, and on the development of the port sector. This is expected to further fuel the market growth over the estimated time period.

MARKET OPPORTUNITIES

The emergence of Intelligent Transportation Systems (ITS) in the port and terminal operation sector is expected to offer significant opportunities for the growth of the market over the forecast period. ITS technologies can improve the productivity and safety of intermodal freight operations. ITS-related technologies address operational efficiency problems. Furthermore, the increasing investments by private organizations and governments in maritime technology is expected to contribute to the growth of the market.

MARKET RESTRAINTS

Port congestion has been a problem in the shipping industry since a long time. Therefore, it is a key issue which is expected to restrain the growth of the market. Also, several factors such as low infrastructure capacity, increased consumer spending, unforeseen events, lack of digitalization, and customs clearance is expected to hinder the growth of the market. In addition, other issues such as fresh liabilities, delays and interruption, and emerging, rapidly accelerating, and converging risks are expected to have a negative impact on the growth of the market.

MARKET GROWTH CHALLENGES

Several ports and terminals have been facing increasing pressure to adapt to some environment-friendly solutions such as the use of dredged materials, reduction in carbon emission, general waste reception, wastewater, solid waste management and other solutions. Also, Port transportation are using technologies such as big data, cloud computing, the Internet of Things (IoT), and others. These technologies make port operations vulnerable to cyberattacks. This is expected to act as a major challenge for the growth of the market.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the global Ports and Terminal Operations market including, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. An increasing port trade and expansion of maritime logistics services has led to rise in demand for port and terminal services. In addition, high economic growth in coastal areas has led to the increasing demand for these services market and therefore, the market is expected to witness growth at a specific CAGR from 2022-2029.

PORTS AND TERMINAL OPERATIONS MARKET SEGMENTAL OVERVIEW

Global Ports and Terminal Operations market comprises of different market segments like service, application, and geography.

PORTS AND TERMINAL OPERATIONS MARKET BY SERVICE

On the basis on service, the Ports and Terminal Operations market consists of key segments like

- Stevedoring

- Cargo and handling transportation

- Others

The stevedoring segment is expected to gain the major market share over the forecast period as it is used in primary operations between ports and terminals. Stevedoring are a set of loading and unloading operations along with performing tasks such as placing, sorting, fastening, and protecting the load inside the vessel. This is a key factor which is expected to drive the growth of the segment over the forecast period.

Also, cargo and handling transportation segment is expected to witness high growth over the forecast period. It is useful to ensure that consignments are ready for carriage in compliance with operator and IATA regulations, as well as with export and import rules of the countries through which the cargo will transit.

PORTS AND TERMINAL OPERATIONS MARKET BY APPLICATION

The global Ports and Terminal Operations market finds major applications in

- Food Transportation

- Coal Transportation

- Steel Transportation

- Others

Food transportation is expected to lead the market during the forecast period. The increasing demand for quality transportation from the food sector is expected to drive the growth of the segment. An increasing demand for food and beverage products especially in the Asian region due to a rise in disposable income as well growing demand for refrigerated and fresh food and frozen food is expected to boost the growth of the food transportation segment.

The coal transportation segment is expected to witness high growth over the estimated time period. Ports and terminal operations play a major role in coal transportation as they are used for shipping different types of coals such as thermal, coking, etc., using railroads or ships at terminals with cranes.

PORTS AND TERMINAL OPERATIONS MARKET BY GEOGRAPHY

The Global Ports and Terminal Operations market is studied for the following region:

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

North America is expected to dominate the market over the forecast period. The growth of the market in North America can be attributed to the presence of a well-developed port sector and investment in maritime logistics. According to the U.S. Bureau of Economic Analysis, trade volumes through U.S. ports reached a record level in 2021 of $2.9 billion, a 21.6% increase compared to 2020.

Apart from that, Europe is projected to witness slow growth due to delayed investments which have postponed the modernization of port infrastructure. Furthermore, the Asia- Pacific region is expected to grow at the highest CAGR due to the port development in countries like China and India.

COVID-19 IMPACT ANALYSIS ON THE GLOBAL PORTS AND TERMINAL OPERATIONS MARKET

Axiom MRC provides a 360-degree analysis of micro and macro-economic factors with regard to the Ports and Terminal Operations market. The report involves an exclusive study on COVID-19 impact analysis. In addition, the report also includes a complete analysis of changes in the global Ports and Terminal Operations market, expenditure, and economic and international policies on the supply and demand side. The report also studies the impact of pandemics on global economies, international trade, business investments, GDP, and marketing strategies of key players present in the market. COVID-19 has caused a negative impact on the port and operational terminal operations around the globe. During the COVID pandemic there has been a shortage of port equipment, a reduction of port staff, a closure of some transportation routes, and a backlog of goods in terminals, warehousing, and distribution centers. This led to a traffic jams at ports which significantly impacted the port sector. Many large containers were left stranded, which further resulted in high detention fees. A study report by UNCTAD, estimates global merchandise trade to have fallen by 5 percent in the first quarter of 2020 and expects a deeper contraction of 27 percent in the second quarter of 2020. These factors are affecting the port and terminal operations market negatively. But with the end of lockdown restrictions, the market is expected to witness new growth opportunities in the upcoming years.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Ports and Terminal Operations market is majorly focused on expanding the global growth of Ports and Terminal Operations with new product innovation, business expansion, and the increasing presence of a range of manufacturers operating in Ports and Terminal Operations has led to the growing demand for the market. Besides, the market offers a range of products in different applications to fulfil the requirements of consumers, which is further contributing to healthy growth in the market.

The key players studied in the market are

- APM Terminals (Netherlands)

- China Merchants Port Holdings Co. Ltd. (China)

- COSCO SHIPPING LINES CO.LTD (China)

- DP World (United Arab Emirates)

- Eurogate Container Terminal Ltd. (Cyprus)

- Hutchison Port Holdings Trust (Singapore)

- International Container Terminal Services Inc. (Philippines)

- Ports America Inc (United States)

- PSA International Pte. Ltd (Singapore)

- SAAM (Chile)

- Indonesia Port Corporations (Indonesia)

- Yilport Holdings (Turkey)

- Dubai Ports World (United Arab Emirates)

- APM Terminals (Netherlands)

RECENT DEVELOPMENT:

October 2022: APM Terminals has signed a collaboration with Bahraini stakeholders. Under this transaction, the Minister of Transportation and Telecommunications, the joint efforts of the company, and the Bahraini government will be going to develop the maritime sector in the Kingdom and strengthen the role of Khalifa Bin Salman Port as a major hub in the Gulf.

June 2022: TecPlata S.A., had entered into an agreement with Vessel S.A., one of Uruguay’s major feeder operators, for the operation of a new weekly service between the La Plata Port and the Port of Montevideo in Uruguay.