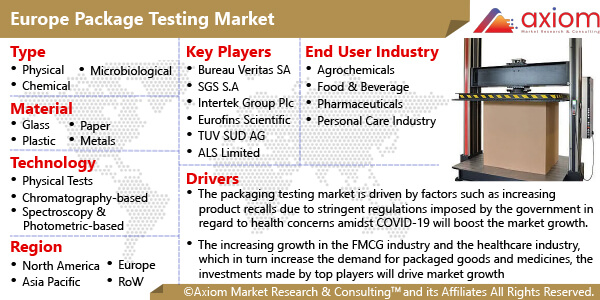

MARKET OVERVIEW- EUROPE PACKAGE TESTING MARKET

Europe has been showing significant growth in the packaging testing market in the coming forecast period. The increasing change in edible product packaging, with the main focus on enhancing the shelf life of food packaged products, as well as reducing the cost of damaged packaged products. In addition, the increasing demand for perfumery, cosmetics, and pharmacy products in the region will boost the market’s growth. The awareness about eco-friendly packaging such as paper-based packaging solutions also has driven the market in the mentioned forecast period.

MARKET DRIVERS

The packaging testing market is driven by an increase in consumer demand for safe and long-lasting products that are safe and free of any contamination. The demand is also boosted due to the increasing awareness of eco-friendly packaging. The demand for packaging testing in pharmaceuticals, food & beverages, personal care goods, agrochemicals, and others will drive the market expansion over the forecast period. The tremendous growth taking place in the FMCG industry and the increase in product recalls due to stringent rules by the Food Safety Association will further lead to market growth in the European region.

MARKET OPPORTUNITIES

The traditional method has been changed by intelligent active packaging, smart packaging, and modified atmosphere packaging. Technological advancement and key investment by industry players also offer significant growth opportunities during the forecast period. Apart from the food industry, the beverage industry is also blooming and will drive the demand for glass packaged testing in the region. According to the study of FEVE, the EU’s consumption of products packed in glass has grown by about 39%, and glass recycling has increased by 139%. These are the factors that will offer opportunities in the packaging testing market.

MARKET RESTRAINTS

The main constraining factor that has been present in the market is cost. The cost is a major concern that has negatively influenced the market. The increasing high cost of advanced technology increases the cost of the product packaging, and this factor is expected to hinder the market’s growth.

MARKET GROWTH CHALLENGES

The packaging testing industry has been facing key challenges due to the pressure of environmental concerns. Storage is again a concern. Top load testing and compression testing are common tests that are performed to see if packing does not fail during storage. Any failure in packaging testing at warehouses leads to the spoiling of the whole consignment. Finding the perfect material that can act as a barrier to all the environmental conditions is quite a task. Recycling is also a major concern as many companies strive to reduce carbon emissions and develop sustainable product packaging.

ANALYSIS OF CUMULATIVE GROWTH

The report provides an in-depth analysis of the European Package Testing market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. The increasing demand for various package testing in various applications has led to the increasing demand for the market and is expected to witness growth at a CAGR at specific CAGR from 2022-2028.

EUROPE PACKAGE TESTING MARKET SEGMENTAL OVERVIEW

The European Package Testing market comprises different market segments like type, material, technology, end-user industry, and country.

EUROPE PACKAGE TESTING MARKET BY TYPE

By type, Package Testing includes key segments of:

- Physical

- Chemical

- Microbiological

Physical testing is likely to hold significant share owing to its importance in the determination of the physical properties of a product and is an essential application for packaging testing. Also, chemical testing of packaging is likely to hold important share in the market, which is essential for the determination of chemical properties such as corrosion level and overall composition of the material, monitoring product quality, toxic detection, contaminant detection, and meeting other regulatory standards.

EUROPE PACKAGE TESTING MARKET BY MATERIAL

The Package Testing market is segmented into the following materials:

Based on material, for the Package Testing market, plastic material accounted for a major market share. This is attributed to plastic being widely used in the global packaging industry due to its high performance, low, cost, and ease of customization as per requirements. Plastic packaging also acts as an excellent barrier to water, oxygen, and carbon dioxide; it is also lightweight and resistant to chemicals and heat. These factors boost plastic material demand in plastic packaging testing solutions during the forecast period.

EUROPE PACKAGE TESTING MARKET BY TECHNOLOGY

Based on technology, the packaging testing market is divided into:

- Physical Tests

- Spectroscopy & Photometric-based

- Chromatography-based

The physical test is projected to gain a major market share during the forecast time. Physical testing assures reliability, quality, and performance of packaged products. It is also helpful in improving the efficiency of product performance, which will result in cost savings.

EUROPE PACKAGE TESTING MARKET BY END-USER INDUSTRY

The Package Testing market has major end users like

- Agrochemicals

- Food & Beverage

- Pharmaceuticals

- Personal Care Industry

- Automobile

- Transportation

- Environmental

- Others

The Food & Beverage segment will grow at a rapid pace during the forecast period due to increasing consumer awareness regarding food safety. In addition, the government regulates labelling and packaging opening growth opportunities in the packaging, and testing market. The pharmaceuticals segment is likely to hold and it is growing at a significant CAGR during the forecast after the food and beverage segment. It is attributed to the increasing health concerns amidst COVID-19. Whereas, the transportation segment will also growing rapid in the forecast span.

EUROPE PACKAGE TESTING MARKET BY COUNTRY

The European Package Testing market is studied for the following region

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe (Belgium, Austria, Sweden, Switzerland, Poland, Netherlands, etc.)

United Kingdom is expected to hold the lion’s share of the market during to forecast period, since United Kingdom has been showing a positive outlook in the packaging testing market owing to the increasing and expanding e-commerce industry that drives the demand for product packaging in the region. Many retail companies have been launching more retail products in the market and that benefits the packaging testing market. Many companies are coming up with innovative solutions. For example, Charapak in the UK has introduced reversible and returnable packaging. This solution will demand customized cartons, which indeed positively impacts the demand for package testing. The increasing consumption of soft drinks, spirits, wine, and beer in the United Kingdom is also expected to drive growth of beverage packaging, which further will drive the demand for the packaging testing market.

COVID-19 IMPACT ANALYSIS ON THE EUROPE PACKAGE TESTING MARKET

Axiom MRC provides a 360-degree analysis of micro and macro-economic factors in the global Package Testing market subjected to COVID-19. In addition, a complete analysis of changes in the global Package Testing market expenditure, and economic and international policies on the supply and demand side. The report also studies the impact of pandemics on global economies, international trade, business investments, GDP, and marketing strategies of key players present in the market. The packaging companies have witnessed significant growth in revenue by serving the e-commerce industry since the outbreak of COVID-19. During the COVID-19 pharmaceutical sector has seen exponential growth due to the rising concern about health and that has led to product safety, so it will further drive the growth of the packaging testing market. In 2020, Beatson Clark, the UK-based pharmaceutical container company, announced that its production and warehouse facilities were fully operational during COVID-19 in order to maintain the supply of bottles and jars for the pharmaceutical sector.

ANALYSIS OF COMPETITIVE LANDSCAPE

The competitive landscape analysis of the Package Testing market is majorly focused on expanding the growth of European package testing with new product innovation, business expansion, and the increasing presence of manufacturers operating in Package Testing has led to the growing demand for the Package Testing market. Besides, the market offers a range of products in different applications to fulfil the requirements of consumers, which is further contributing to healthy growth in the market.

The key players studied in the market are

- ITC ZLIN

- SGS SA

- UL Solutions

- Micom Laboratories

- Intertek

- Merieux Nutrisciences

- Eurofins USA

- Mondi

- TUV SUD.

- Smithers

- Tektronix

RECENT DEVELOPMENT:

April 2021: SGS announced the launch of its new comprehensive footwear packaging testing protocol, this campaign supports brand owners and retailers, including e-commerce, in delivering packaging that performs well, meets environmental and sustainability standards and ensures consumers receive footwear in prime condition.