COVID-19 IMPACT ANALYSIS ON THE GLOBAL MARITIME ANALYTICS MARKET

The exclusive COVID-19 impact analysis report by Axiom MRC provides a 360-degree analysis of micro and macro-economic factors in the global maritime analytics market. In addition, complete analysis of changes in the global maritime analytics market expenditure, and economic and international policies on the supply and demand side. The report also studies the impact of pandemics on global economies, international trade, business investments, GDP, and marketing strategies of key players present in the market. The interruptions in movement, flow, and storage of goods due to the COVID-19 outbreak have affected the overall region's logistics and transportation industry growth. The outbreak has also adversely impacted the overall competitiveness, job market, and economic growth of many countries in the region. China is one of the critical countries in international trade, with some of the busiest ports such as Shanghai and Yangtze ports. With restrictions on international trade activities, entry and exit of ships, cargo backlogs, and quarantine measures, some of the largest logistics shipping contractors have stopped their operations in China.

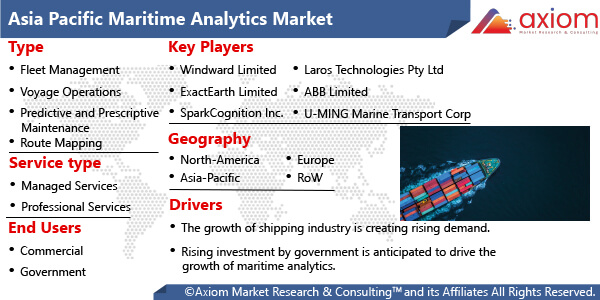

MARKET OVERVIEW- APAC MARITIME ANALYTICS MARKET

The increasing use of algorithms and predictive analytics in the shipping sector and the growing trend of digitalization and automation are propelling the growth of the maritime analytics market across the world. Maritime analytics software or platforms provides numerous key benefits such as superior performance, improved productivity, cost savings, improved safety, and valuable perceptions associated with several parameters for stakeholders involved in the maritime and shipping industry. In addition, the APAC shipping industry is emerging at a rapid pace due to changes in the technology landscape, the rise in trade across countries, and growth in the worldwide economies and geopolitical situations. These factors pose numerous opportunities for players operating in the industry.

MARKET DRIVERS

The APAC Maritime Analytics market is driven by the integration of digital technologies in maritime processes, operations, and business models to enhance productivity, increase security, and reduce operational costs has been growing at an unprecedented rate. Due to escalating customer demands and industry competitiveness, digital transformation has become a fundamental need for any company's long-term success and competitive advantage. Companies in the region are adopting digitization to improve their business processes to increase operational throughput and profits. The marine industry is no exception to this tendency, and it is currently undergoing a paradigm transition because of shifting business models, technological adoption, cost structures, and increased competition.

MARKET OPPORTUNITIES

The market is expected to have a new opportunity with rising investment by the government in the maritime and shipping industry is expected to provide ample new growth opportunities in the market during the forecast period. Along with the current digitalization initiatives, governments across the world are implementing numerous technologies such as artificial intelligence, big data, and the Internet of Things (IoT) in the maritime sector. Thus, rising initiatives and investment by the governments in the field of shipping and the maritime industry is boosting the market growth. For instance, in India, in February 2021, the Major Port Authorities Bill, 2020 was passed by the Parliament of India. The bill aims to decentralize decision-making and reinforce excellence in major port governance.

MARKET RESTRAINTS

The market has major restraining factors like a lack of skilled workforces to handle and operate maritime automation systems. Maritime Analytics being an advanced machine can significantly include investment and maintenance costs and this factor is expected to act as a hurdler for the market growth over the forecast period. Besides, the lack of a skilled workforce is another factor restraining the market growth.

MARKET GROWTH CHALLENGES

Concerns related to cyber security in Maritime Automation Systems hampered the growth of the market to a major extent which has created a major challenge for the market growth. Automation and digitization in the maritime industry, in ships worldwide, increase the threats of cyber security as these ships follow satellite directions during their voyages. Shortly, the operators of marine vessels are anticipated to connect their ships to onshore networks. Among operators and ship owners, there are concerns that better connectivity could bring about more cybersecurity risks. These concerns are understandable. Along with digitalization, the need for greater cybersecurity is an important factor. More onboard digital equipment connected to the Internet poses a broader attack surface for accidental or targeted cyberattacks, which could hamper the market growth.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the APAC Maritime Analytics market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. With the increasing demand for various Maritime Analytics in various applications has led to the increasing demand for the market and is expected to witness growth at a CAGR at specific CAGR from 2021-2028.

MARITIME ANALYTICS MARKET SEGMENTAL OVERVIEW

The Asia PacificMaritime Analytics market comprises different market segments like type, services type, end users and Country.

MARITIME ANALYTICS MARKET BY Type

By type, Maritime Analytics includes key segments of

- Fleet Management

- Voyage Operations

- Predictive and Prescriptive Maintenance

- Route Mapping

- Others

The fleet management segment dominated the market in 2021 and is expected to maintain its dominance during the forecast period. Maritime analytics solution uses the power of machine learning and AI to model normal at-sea performance, identify deviations, and eventually mitigate equipment failures with adequate lead time to plan comprehensive and timely fleet maintenance. In addition, maritime analytics solution allows shipping personnel to prototype fleet management use cases and extremely precise predictive machine learning models with depth, speed, and accuracy which are not available in traditional methods.

MARITIME ANALYTICS MARKET BY Service Type

The Maritime Analytics market has major service types in

- Managed Services

- Professional Services

Based on service, for the maritime analytics market, the managed service holds the major share in the market, since managed service helps the end-users in numerous ways, such as, with the help of managed services, the entire network can be managed and proper operations of the maritime analytics can be also ensured. Also, it is a cost-effective solution for the end-users with less capital and manpower. Moreover, the managed services providers assist the end-users with 24 hours dedicated team which takes care of the smooth functioning of the system and helps in the efficient use of the system.

MARITIME ANALYTICS MARKET BY END USERS

The Maritime Analytics market has major end users like

The commercial segment dominated the market in 2021 and is expected to maintain its growth at a considerable growth rate. The increased adoption of sensors, connected devices, and digital communication channels, which is associated with the critical real-time use of data, has increased the use of analytics in the maritime industry. Although the maritime industry was not among the first to adopt analytics-based solutions, the increasing seaborne trades, combined with a high level of commercial adoption, are driving the maritime analytics market growth. Moreover, cruise ships are the kind of passenger ships that come under commercial segments, and with a rising number of tourism activities and a rise in disposable income for individuals, companies are highly spending on cruise ships and numerous automation companies provide their products for equipment monitoring, navigation support, and safety improvements to shipbuilding companies.

MARITIME ANALYTICS MARKET BY COUNTRY

The APAC Maritime Analytics market is studied for the following region

- China

- India

- Japan

- Rest of the APAC

The Asia Pacific is a manufacturing hub with countries such as China, Japan, and India focusing on the manufacturing of consumer electronics, semiconductors, and automobiles. China is a major consumer and producer of many key industries, including automotive, electronics & semiconductors, commodities, and agricultural products. The interruptions in movement, flow, and storage of goods due to the COVID-19 outbreak have affected the overall region's logistics and transportation industry growth. The outbreak has also adversely impacted the overall competitiveness, job market, and economic growth of many countries in the region.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Maritime Analytics market is majorly focused on expanding the APAC growth of Maritime Analytics with new product innovation, business expansion, and the increasing presence of a range of manufacturers operating in Maritime Analytics has led to the growing demand for the market. Besides, the market offers a range of products in different applications to fulfill the required demand of consumers which is further contributing to healthy growth in the market.

The key players studied in the market are

- U-MING Marine Transport Corp

- ProGen Business Solution

- Amplify Mindware Pvt. Ltd

- RightShip

- Kayrros

- Q88 LLC

- Signal Group

- eeSea Aps

RECENT DEVELOPMENT:

September 2020: Ericsson collaborated with Taiwanese bulk carrier U-Ming Marine Transport Corporation (U-MING) to digitize fleet performance management via intelligent Internet of Things (IoT) connectivity. The benefits will include increased efficiency, increased safety, lower costs, and reduced environmental risks. The new fleet performance management platform (FPM) will allow professionals at U-Operations MING's Center to monitor the fleet's operations in near real-time while at sea.