MARKET OVERVIEW: DIAGNOSTIC IMAGING MARKET

Diagnostic imaging refers to various methods of peering inside the body to ascertain a diagnosis and determine the origins of an illness or injury. Additionally, doctors use it to assess how well a patient's body responds to fracture or illness treatment. Diagnostic imaging enables medical professionals to see inside patient’s body to help them look for any signs of a health issue. Images of the processes and structures inside patient’s body can be created using certain tools and techniques. Depending on the body part they are examining and patient’s symptoms, doctor will decide which imaging tests are necessary. Numerous imaging procedures are simple, painless, and non-invasive. However, some will require to remain motionless inside the machine for a considerable amount of time, which can become somewhat uncomfortable. Some tests expose test subjects to a small amount of radiation. A small camera on a long, thin tube will be inserted into patient’s body by the physician for additional imaging tests. A "scope" is the term used to describe this item. Once inside an organ, such as patient’s heart, lungs, or colon, they'll move the scope through a bodily opening or passageway. For these procedures, patient might require anaesthesia. Health Images offers a full array of diagnostic imaging services, including the MRI Scans, MRA Scans, CT scans, Ultrasound, X-rays, Mammography, Bone Density Scans, Arthrogram, Myelogram.

MARKET DRIVERS

The demand for point-of-care imaging systems and the surge in enhanced optical image demand for more accurate disease and disorder diagnosis are the main factors driving the growth of the global medical imaging market share. Additionally, the rise in chronic disease incidence and technological developments in medical imaging are anticipated to drive the market's expansion. Additionally, the market will grow more quickly due to favourable regulatory conditions for medical imaging modalities for better patient management and rising usage of medical imaging in digital health. Important market players are refocusing their efforts on value-based radiology and patient-centred imaging. Numerous imaging modalities, such as MRI, ultrasound, mammography, 3D imaging, and nuclear imaging, among others, have undergone various advancements. According to the Centres for Disease Control and Prevention (CDC), nearly 80% of the elderly in the US suffer from at least one chronic condition. These factors are expected to increase the growth of the diagnostic imaging market during the forecast period.

MARKET OPPORTUNITIES

The major market opportunity for diagnostic imaging is found in developing nations like South Africa, Russia, India, China, and other affluent economies. Although affordability is a concern in these developing nations, their enormous populations, particularly in India and China, provide a stable market for diagnostic imaging equipment. The greater prevalence of chronic conditions like cancer, stroke, neurological and cardiovascular diseases, as well as the higher death rates in these nations, highlight the importance of early detection.

MARKET RESTRAINTS

One of the main market restrictions to market growth is product price fluctuations. The market growth of standalone imaging modalities is negatively impacted by the technological constraints attached to them. For instance, MRI requires more time to scan large areas or produce images with high resolution, whereas PET has a lower level of spatial resolution. Ultrasound systems have limited tissue depth penetration, a high operator dependence rate.

MARKET GROWTH CHALLENGES

In response to mounting government pressure to reduce healthcare costs, a number of healthcare providers have allied with group purchasing organisations (GPOs), integrated health networks (IHNs), and integrated delivery networks (IDNs). These groups pool the purchasing power of their members and haggle with medical device suppliers and manufacturers for a fair price. For large purchases of diagnostic imaging devices, GPOs, IHNs, and IDNs engage in intense bargaining. The above factors are expected to hamper the growth of the diagnostic imaging market.

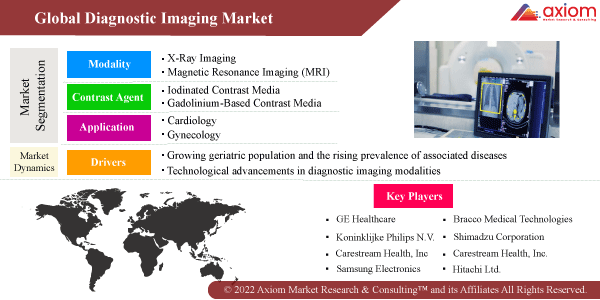

DIAGNOSTIC IMAGING MARKET SEGMENTAL OVERVIEW

The report analyses the global diagnostic imaging market based on the by modality, contrast agent, application, end users and geography.

DIAGNOSTIC IMAGING MARKET BY MODALITY

Diagnostic Imaging Market by Type

- X-Ray

- Magnetic Resonance (MRI)

- Ultrasound

- Computed Tomography (CT)

- Nuclear

- Mammography

The computed tomography (CT) segment is anticipated to dominate the market during the forecast period. The high growth of the CT scan market can be attributed to the rising need for early and precise diagnosis along with the widespread use of CT scanners in hospitals and diagnostic facilities worldwide. Since the COVID-19 pandemic began, the demand for CT scanners has been steadily rising. A CT scan of the chest is almost always required to track the course of the disease and is crucial for the diagnosis of COVID-19.

DIAGNOSTIC IMAGING MARKET BY CONTRAST AGENT

- Iodinated contrast media

- Gadolinium-based contrast media

- Microbubble contrast media

- Barium-based contrast media

The Iodinated contrast media segment is anticipated to hold the majority of market share during the forecast period. For use in x-ray-based imaging techniques like computed tomography, iodinated contrast media are contrast agents that contain iodine atoms (CT). Additionally, they can be used in fluoroscopy, venography, angiography, and occasionally even plain radiography. Over the course of the forecast period, gadolinium contrast media is anticipated to expand significantly. The rare earth metal gadolinium is chelated to a carrier ligand to form gadolinium contrast agents, which are molecular complexes. They fall under the category of paramagnetic contrast agents, which make up the majority of MRI contrast media.

DIAGNOSTIC IMAGING MARKET BY APPLICATION

- Cardiology

- Gynaecology

- Orthopaedics & Musculoskeletal

- Radiology

- Neurology & Spine

- General Imaging

The cardiology segment is anticipated to experience the fastest growth during the forecast period. Cardiology's share of the Diagnostic Imaging market has grown significantly as a result of the rise in cardiovascular patients brought on by unhealthy eating habits and changing lifestyles. Contrarily, orthopaedics is anticipated to experience the fastest growth over the forecast period. The demand for the orthopaedic segment is being driven by the growing elderly population and the increase in traffic accidents. Additionally, the availability of cutting-edge diagnostic tools is promoting market expansion.

DIAGNOSTIC IMAGING MARKET BY END USERS

- Hospitals

- Diagnostic centres

- Ambulatory care centres

- Clinics

The hospitals segment is expected to increase during the forecast period. The advancement of the industry will be aided by the increased demand for medical imaging equipment in hospital settings, such as MRI systems and CT scanners, for precise diagnosis during procedures. Hospitals are also well-equipped with medical imaging equipment and have qualified medical staff on staff, allowing for precise treatment and body part diagnosis.

DIAGNOSTIC IMAGING MARKET BY GEOGRAPHY

- North America

- Europe

- Asia-Pacific

- Rest of the world

The North America is likely to gain major market share and maintain its dominance over the estimated time period. The primary factor of market demand is the United States, which holds the lion's share of the market for diagnostic imaging. This is because of the country's higher affordability rates among the populace, growing number of diagnostic procedures performed annually, and the country's rapid technological advancements. The Ysio Max digital radiography system, which has new detectors and usability features that enhance imaging and speed up exams, was also approved by the FDA in October 2020 and was manufactured by Siemens Healthineers. Furthermore, the market is anticipated to expand over the course of the forecast period due to the presence of well-established healthcare facilities, rising demand for cutting-edge healthcare systems among the ageing population, and rising prevalence of chronic diseases.

COVID-19 IMPACT ANALYSIS ON GLOBAL DIAGNOSTIC IMAGING MARKET

A 360-degree analysis of micro and macro-economic factors on the global Diagnostic Imaging market is provided in this exclusive report generated by Axiom MRC. In addition, complete analysis of changes on the global Diagnostic Imaging market expenditure, economic and international policies on supply and demand side is provided in this exclusive report. The report also studies the impact of pandemic on global economies, international trade, business investments, GDP and marketing strategies of key players present in the market. The COVID-19 pandemic is expected to have a significant impact on the market. According to an article titled "Admission chest radiograph predicts early intubation in hospitalized COVID-19 patients", published in European Radiology in November 2020, chest x-ray has been useful in identifying COVID-19 patients, who may be rapidly deteriorating, and in helping inform clinical management and a hospital bed and ventilator assignment. This should increase the use of these devices in hospital COVID wards. In April 2020, the German Radiological Society (DRG) published a guideline on the use of CT scans in COVID-19 patients. According to the DRG, a CT scan is recommended in a clinically symptomatic patient with an initially negative PCR and clinical sequelae to support the diagnosis of COVID-19. It is also recommended to confirm the CT result by sequential reverse transcription PCR (RT-PCR). Similarly, the National COVID-19 Chest Imaging Database (NCCID) was launched in the UK in April 2020, providing a more comprehensive understanding of COVID-19, compiling data from X-rays, CT scans and 'MRIs of 20 NHS trusts across the country, disease models and markers of the virus using artificial intelligence (AI), which in turn enables more accurate early diagnosis and prognosis and informs new treatments. This is expected to drive demand for such devices and tests during the COVID-19 pandemic.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of Diagnostic Imaging market is majorly focused on expanding the global growth of diagnostic imaging sector with new product innovation, business expansion, increasing presence of range of manufacturers operating in diagnostic imaging industry has led the growing demand for the market. Besides, the market offers range of products in different application to fulfil the required demand of consumers which is further contributing healthy growth in the market.

The key players studied in market are

- GE Healthcare (United States)

- Koninklijke Philips N.V. (Netherlands)

- Hologic, Inc (United States)

- Siemens Healthcare GmBH (Germany)

- Fujifilm Corporation (Japan)

- Bracco Medical Technologies (Italy)

- Toshiba Medical Systems Corporation (Japan)

- Shimadzu Corporation (Japan)

- Carestream Health, Inc. (United States)

- Hitachi Ltd (Japan)

RECENT DEVELOPMENT:

November 2022: Arterys, a Leader in Cloud Medical Imaging, Grows Product and Partner Lineup, Supports Launch of Amazon HealthLake Imaging- Arterys, developer of the world's first internet platform for medical imaging, now part of Tempus, announced its organic growth of products and partnerships to serve radiologists with even faster and more accurate diagnostic tools.

April 2022: Wipro GE Healthcare Launched ‘Made in India’ CT System to Strengthen Access to Quality Healthcare Across India- Wipro GE Healthcare, a leading global medical technology and digital solutions innovator, announced the launch of its next-generation Revolution Aspire CT (Computed Tomography) scanner. Revolution Aspire is an advanced imaging solution designed and manufactured end-to-end in India, at the newly launched Wipro GE Medical Devices Manufacturing plant, in line with ‘Atmanirbhar Bharat’ initiative. The CT system is equipped with higher imaging intelligence to improve clinical confidence when diagnosing diseases and anomalies.

November 2021: Philips launched new AI-enabled MR portfolio of smart diagnostic systems, optimized workflow solutions and integrated clinical solutions at RSNA 2021- Royal Philips, a global leader in health technology, today announced new AI-enabled innovations in MR imaging launching at the Radiological Society of North America (RSNA) annual meeting (November 23 – December 2, Chicago, USA). Philips’ new MR portfolio of intelligent integrated solutions is designed to speed up MR exams, streamline workflows, optimize diagnostic quality, and help ensure the efficiency and sustainability of radiology operations.

May 2021: Royal Philips had launched spectral detector-based Spectral Computed Tomography (CT) 7500. This latest intelligent system delivers high-quality spectral images for every patient on every scan 100% of the time to help improve disease characterization and reduce rescans and follow-ups, all at the same dose levels as conventional scans.