MARKET OVERVIEW- ASIA PACIFIC ENVIRONMENTAL SENSORS MARKET

Environmental sensors measure the environmental conditions of the data centre such as the temperature and humidity. Real-time data from environmental sensors is collected, monitored, and reported on by data center infrastructure management software to help data center managers see trends, get alerts, save energy, and increase uptime. Technological advancement in the design and engineering of individual sensors is expected to drive the market over the forecast period. Growing demand from the industrial as well as the agriculture sector is expected to positively impact market growth. Further, the rising installation of environmental monitoring stations, increasing use of environmental sensors in the industrial sector, and stringent environmental regulation to reduce environmental pollution are the key factors driving the growth of the environmental sensors market.

MARKET DRIVERS

The market for environmental sensors is expected to experience considerable growth potential due to the rise in pollution each year brought on by increased air travel, autos, and other factors. The development of industry 4.0, which develops a market for environmental sensors, adds to this. Further, the growth of the global population has had to increase industrial development and activity simultaneously. The unsustainable practices across industries have resulted in rapid degradation of soil, air, and water quality worldwide, which has, in turn, led to an increase in the demand for devices that can help detect environmental changes.

MARKET OPPORTUNITIES

The use of internet of Things (IoT) Technology and Nanotechnology for Environmental Monitoring products offers opportunities for the growth of the Environmental sensors market. IoT applications for environmental monitoring include protection, monitoring for extreme weather, water. Safety, protecting endangered species, and industrial farming. Sensors are used in these applications to identify and quantify all environmental changes. Additionally, nanotechnology works with material at sizes between 1 and 100 nm. By increasing sensor specificity, it significantly contributes to the detection of pollutants. Nanotechnology-enabled sensors and solutions can detect and identify chemical or biological agents in the air and soil with higher sensitivity. Thus, the growing use of Internet of Things technology and nanotechnology for environmental monitoring product is create a lucrative opportunity for the market.

MARKET RESTRAINTS

However, the lack of awareness about sensors and high costs associated with environmental sensors are factors challenging the market growth. Also, long-term monitoring of environmental data may lead to a short life span of sensors is likely to hamper the growth of the environmental sensors market.

MARKET GROWTH CHALLENGES

The stringent performance requirements of advanced sensor applications are estimated to challenge the growth of the environmental sensors market. For example, consumer electronics applications have stringent requirements regarding the size and power consumption of environmental sensors. In such cases, integrating several types of sensors with consumer applications such as smartphones, becomes very difficult.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the Asia Pacific environmental sensors market, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. The growing adoption of nanotechnology-based environmental monitoring products has led the increasing demand for market and is expected to witness the growth at a specific CAGR from 2023-2029.

ASIA PACIFIC ENVIRONMENTAL SENSORS MARKET SEGMENTAL OVERVIEW

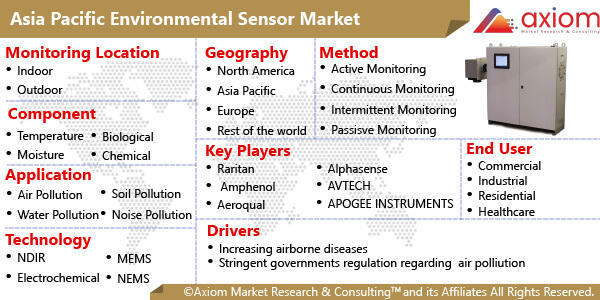

The Asia Pacific environmental sensors market comprises of different market segments like component, method, technology, application and Country.

ASIA PACIFIC ENVIRONMENTAL SENSORS MARKET BY COMPOENENT

By component, the Asia Pacific environmental sensors market includes the key segments of

- Temperature

- Moisture

- Humidity

- Chemical

- Gas

- Particulate Matter

The temperature segment is expected to dominate the market over the forecast period. A smart temperature sensor is an integrated system consisting of a temperature sensor, bias circuitry, and an analog-to-digital converter (ADC). A temperature sensor measures heat to ensure a process stays within a specific range, providing safe application usage or meeting a necessary condition when dealing with extreme heat, hazards, or inaccessible measuring points. Temperature sensors are being incorporated into intelligent camera systems designed to offer accurate and non-contact temperature monitoring across various disciplines. The applications include manufacturing process control, product development, waste management, facilities maintenance, emissions monitoring, and environmental, health, and safety (EHS) improvements. These factors expected to boost the segment’s growth.

ASIA PACIFIC ENVIRONMENTAL SENSORS MARKET BY METHOD

By method, the Asia Pacific environmental sensors market includes the key segments of

- Active Monitoring

- Continuous Monitoring

- Intermittent Monitoring

- Passive Monitoring

The continuous monitoring segment is expected to dominate the market over the forecast period. The rising government funding towards environmental sustainability, development of policies and initiatives to minimize environmental pollution levels, rising installations of environmental monitoring stations and increases adoption of environmental monitoring strategies by the public and private companies. Adding to that, use of Internet of Things (IoT) technology and nanotechnology provides lucrative opportunities for the growth of method segment in the environmental sensor market.

ASIA PACIFIC ENVIRONMENTAL SENSORS MARKET BY TECHNOLOGY

By technology, the Asia Pacific environmental sensors market includes the key segments of

The ethernet segment is expected to dominate the market over the forecast period. Ethernet is the traditional technology for connecting devices in a wired local area network (LAN) or wide area network (WAN). It enables devices to communicate with each other via a protocol, which is a set of rules or common network language. A range of environment monitors with Ethernet network connections for monitoring and control over an IT network. The devices can be installed with sensors to monitor temperature and humidity in server rooms, datacentres and industrial applications and can report the data. This factor is expected to drive the growth of the segment.

ASIA PACIFIC ENVIRONMENTAL SENSORS MARKET BY APPLICATION

By application, the Asia Pacific environmental sensors market includes the key segments of

- Air Pollution

- Soil Pollution

- Water Pollution

- Noise Pollution

The air pollution segment is expected to dominate the market over the forecast period. The rising environmental pollution levels, increasingly degrading indoor air quality, and growing demand for real-time air quality monitoring sensors to monitor urban air pollution are expected to support the growth of this segment.

ASIA PACIFIC ENVIRONMENTAL SENSORS MARKET BY GEOGRAPHY

The Asia Pacific environmental sensors market is studied for the following regions

- India

- China

- Japan

- Rest of Asia Pacific

The India segment is expected to dominate the market over the forecast period. The region’s country growth is being supported by the region’s governments. Increasing implementation of environmental monitoring and protection policies, as well as the increasing compliance of industrial facilities with environmental monitoring regulations. Further, the rapid proliferation of smart technologies, such as smart cities, autonomous vehicles, IoT applications, home automation, industrial automation, intelligent processing technologies, and others. Such factors are expected to drive the country’s growth. Moreover, the government investing significantly in advanced technologies and more innovative infrastructures. With such rapid developments, sensors in the country are finding widespread applications in smartphones, automobiles, and healthcare. Some of the most common consumer electronics sensors include motion, temperature, and pressure sensors. These factors are expected to support the growth of the Indian environmental sensors market.

COVID-19 IMPACT ANALYSIS ON ASIA PACIFIC ENVIRONMENTAL SENSORS MARKET

The COVID-19 pandemic adversely impacted the global economy. Nationwide lockdowns and social distancing norms were imposed across several countries. These negatively affected multiple industries, including the environmental sensors industry. Uncertainty regarding the duration of the lockdowns made it difficult for the key market players to anticipate the recovery of the environmental sensors market. Several providers of environmental sensors were under immense pressure due to the COVID-19 pandemic. The economies are shifting their focus from responding to the pandemic to economic recovery, and hence, various growth opportunities are expected to emerge for the environmental sensors market players due to the stringent environmental regulations to reduce environmental pollution. However, several businesses are exerting extensively to move the environmental sensors market in the right direction. Local governments are also undertaking several relief steps to mitigate the negative impacts of the COVID-19 pandemic.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Asia Pacific environmental sensors market is primarily focused on expanding the region growth of the Asia Pacific environmental sensors industry through new product innovation, business expansion, and the increasing presence of a range of manufacturers operating in the environmental sensor sector, which has led to growing demand for the market. Besides, the market offers a range of products in different applications to fulfil the required demand of consumer which is further contributing to healthy growth in the market.

The key players studied in market are

- TE Connectivity

- SmartSense

- Monnit Corporation

- AKCP Solutions

- 42U

- Sensaphone

- Raritan Inc.,

- Swift Sensors

- Baumer

- E-Control Systems Inc.

- Honeywell

- Texas Instruments

- Schneider Electric

- Bosch Sensortec

- Sensirion

RECENT DEVELOPMENT:

September 2022: Sensirion announces the STS4xA, a highly reliable digital temperature sensor series specifically designed for automotive applications. The sensor platform supports automated optical inspection and comes with an advanced onboard diagnosis system.

April 2022: AMS, a global company in optical solutions, has introduced a green laser diode which is a brighter, easier to use, more reliable, and cost-competitive replacement for red lasers in applications such as leveling, scanning, biosciences, and dot projection.

July 2021: Minebea Mitsumi launched the durable semiconductor digital temperature and humidity sensor “MW3827”. The MW3827 is a semiconductor digital temperature and humidity sensor that has excellent durability and small characteristics fluctuation even under high temperature ad high humidity conditions.

March 2021: Monnit announced launch of its ALTA Soil Moisture Sensor. Primed to meet AgriTech market demand, the soil moisture sensor alerts on mobile device or computed how much, when and where to water crops or commercial landscaping.