Anti-money laundering (AML) refers to laws, regulations and procedures developed to prevent criminals from masking illegally obtained funds as legitimate income. While anti-money laundering laws cover a limited range of criminal transactions and behavior, their implications are far-reaching. Companies use anti-money laundering software to detect suspicious transactions and customer data. Compliance professionals also use the software to comply with corporate policies and government regulations, such as the United States Bank Secrecy Act, which aims to prevent money laundering crimes. The software of anti-money laundering uses data collected from various solutions used to manage financial transactions, such as accounting software and an ERP system to reduce money laundering activities.

Anti-Money Laundering Market Dynamics

Some of the major factors fueling the anti-money laundering market include growing stringent regulations and compliances for AML, rising emphasis of financial institutions on digital payment-related issues and holistic view of data to curb financial crimes. However, rising complexities of AML solutions limiting ability of early detection of frauds is restraining the market.

COVID 19 Impact on Anti-Money Laundering Market

Covid19 drastically affects the world supply chain and industrial sector growth. At the initial stages of the pandemic, the world experienced, ‘supply shocks’. In the foreseeable future, the COVID-19 pandemic has accelerated the existing trend toward digital marketplaces. Due to lockdown by governments around the world, everyone is now digitized to meet their daily needs. Digital payments are the main use case. The use of digital wallets or e-wallets has increased. Because of this change, the chances of illegal money transactions have also increased. FATF has warned banks about illegal cash transactions. Because of this, the demand for anti-money laundering solutions has increased; therefore, driving the growth of the market.

Anti-Money Laundering Market Segmental Overview

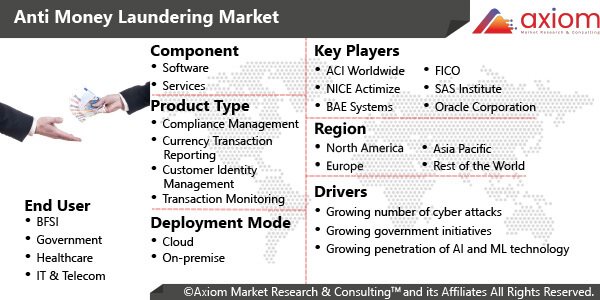

The report analyses the anti-money laundering market based on component, organization size, deployment type, vertical, and geography.

Anti-Money Laundering Market by Component

By component, the global anti-money laundering market is segmented into software and services. Among these, software segment dominated the market. Anti-money laundering software access organizations ensure that the legal requirements framed by government organizations are met.

Anti-Money Laundering by Organization Size

By organization size, the global anti-money laundering market is segmented into small and medium-sized enterprises and large enterprises. Large enterprises segment is expected to hold a larger market size. Large enterprises were the first to implement AML solutions because they use many business applications that are vulnerable to fraudulent attacks. Because these companies are large, with different types of IT infrastructures, they face the challenge of effectively managing the security of their applications.

Anti-Money Laundering Market by Deployment Type

The global Anti-Money Laundering by deployment type is classified into on-premise and cloud. Among these, the on-premise segment holds the largest market size. On-premises solutions gives organizations complete control over the platforms, applications, systems and data that IT staff can manage. In organizations where user accreditation is essential to business operations, adoption is higher because it can control systems.

Anti-Money Laundering Market by Vertical

The global anti-money laundering by vertical is classified into banking and financial, insurance providers, gaming and gambling and others. Anti-money laundering regulations define the measures that banks must take into account to prevent and detect financial crime, which creates demand for anti-money laundering solutions in the banking and financial segment.

Anti-Money Laundering Market by Geography

Geographically, the anti-money laundering market is studied across the countries of key regions such as, North America, Europe, Asia Pacific and the rest of the world regions which includes Latin America, and Middle East & Africa. North America is expected to generate the largest market share in terms of revenue over the forecast period, as it is a technologically advanced region with a large number of early adopters and a presence of major market players. Some of the factors such as the proliferation of inorganic growth strategies among major AML providers and innovations in the implementation of AI, ML in AML solutions, as well as the growing demand for cloud-based AML solutions, will stimulate demand in the anti-money laundering market.

Anti-Money Laundering Key Players

Some of the major players operating in this market include BAE Systems (UK), Nice Actimize (US), FICO (US), SAS Institute (US), Oracle Corporation (US), Experian (Ireland), LexisNexis Risk Solution (US), Fiserv (US), FIS (US), Dixtior (Portugal), TransUnion (US), Wolter’s Kluwer (The Netherlands), Temenos (Switzerland), Nelito Systems (India), TCS (India), Workfusion (US), Napier (UK), Quantaverse (US), Complyadvantage (UK), Acuant (US), and FeatureSpace (UK).