MARKET OVERVIEW- GLOBAL CARDIAC IMAGING SOFTWARE MARKET

Cardiac imaging is a diagnostic test useful in evaluating heart related diseases. Various types of imaging modalities include computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, radiographic imaging and nuclear medicine imaging with SPECT or PET. The cardiac imaging sector has developed significantly in complexity and clinical utility from the past two decades. It provides improved resolution and comprehensive details of heart’s functioning for effective diagnosis. The software can show the supporting and useful changes in the heart that can be additionally considered and analyzed to understand any future and present possible outcomes of heart conditions. Growing demand for advanced medical technologies for diagnostic purposes and increasing prevalence of cardiovascular diseases are some of the drivers for the growth of the market. Also, increasing personal disposable income has led to improvement in healthcare infrastructure in developing nations. This is anticipated to provide ample of new growth opportunity for the market.

MARKET DRIVERS

Medical imaging is an important aspect of the diagnostic process. From ultrasounds to MRIs to CT scans, radiologists require and use medical imaging to accurately detect and treat diseases. Doctors also use medical imaging technologies to identify whether a particular therapy has been effective in patients. Over the years, the expertise of medical imaging has outwardly improved. With continuous research and technological advancements, several developments in medical imaging technology can be observed. This progress is important in offering more precise diagnoses and enhancing patient care. Combing these advancements with the power of IT and digital growth also results in greater procedural efficiency in the provision and execution of patient care. The use of 3D (and potentially even 4D) technologies in diagnostic radiology has the knack to generate better images, for powerful results. Though ultrasounds are very popular in the medical field, they are limited by the inability to obtain high-resolution, detailed images. Using 3D technology, it is possible to improve ultrasound resolution, and enhance patient care. Hence, technological advancements in medical imaging systems is one of the factor driving the growth of the cardiac imaging software market.

MARKET OPPORTUNITIES

The advancement of AI is creating opportunities in the healthcare industry to extract more sophisticated insights from imaging and to find patterns in available data sources that are too complex for the human brain. It is implemented in the clinical workflow based on research results showing equivalent or better performance than physician analysis or traditional (semi-)automated methods to reduce physician workload and improve decision making. The use of AI in cardiac CT affects many steps in the imaging chain. In contrast, the application of AI in cardiac MRI has so far mainly focused on the automated segmentation of anatomical structures of the heart. There is also an opportunity for future research to focus on implementing data from multiple sources into machine learning (ML) models, including biomarkers, genomics, proteomics, and metabolomics and this factor is expected to provide rising new growth opportunities for the market over the forecast period.

MARKET RESTRAINTS

The high costs of cardiac imaging software is expected to restrain the growth of the market. These costs are largely attributed to expensive modern equipment, intensive use of diagnostic tests, and pharmaceutical and medical interventions. The cost of imaging in the United States exceeds $ 100 billion annually. Cardiovascular imaging (CVI) accounts for 29% of all imaging workload and at least one third of the billions of medical imaging studies performed worldwide each year. Additionally, this was partly attributed to proprietary software products and their designed compatibility with other software and hardware vendors. These factors are expected to restrain the market growth during the estimated time period.

MARKET GROWTH CHALLENGES

There is a lack of standardization among vendors. This makes it difficult to conduct population-based cross-site studies that can collect data from materials developed by different vendors. This is expected to hamper the growth of the market. Also, lack of skilled professionals in low-income countries is expected to be a major challenge for the market growth over the forecast period.

CUMULATIVE GROWTH ANALYSIS

The report provides in-depth analysis of global Cardiac Imaging Software market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. With increasing demand for cardiac imaging software in various applications has led the increasing demand for market and is expected to witness the growth at a CAGR at specific CAGR from 2021-2028.

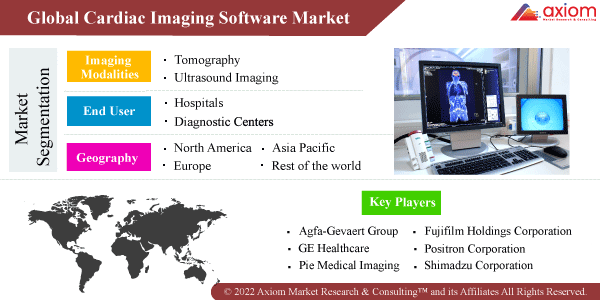

CARDIAC IMAGING SOFTWARE MARKET SEGMENTAL OVERVIEW

The global Cardiac Imaging Software market comprises of different market segments like imaging modalities, end user and geography.

CARDIAC IMAGING SOFTWARE MARKET BY IMAGING MODALITIES

Various modalities covered under imaging modalities are

- Tomography

- Ultrasound Imaging

- Radiography imaging

- Combined Modalities

Tomography segment accounted for the majority of the market share in 2020 and is projected to maintain its dominance during the estimated time frame. Major growth factors such as growing popularity of cardiac imaging techniques such as computed tomography, magnetic resonance imaging, positron emission tomography and single-photon emission computed tomography and increasing number of benefits and applications provided by these techniques and related software solutions are attributed to the healthy growth of the market. In addition, rising adoption of tomography machines such as CT scanners, MRI machines, and PET scanners and thus increased demand for software tools required to perform image analysis is expected to improve growth of the market during the projection period.

CARDIAC IMAGING SOFTWARE MARKET BY END USERS

The Cardiac Imaging Software market has major end users like

- Hospitals

- Diagnostic Centers

- Research centers

- Others(ambulatory surgical centers and clinics)

Hospital is anticipated to be the major end user dominating the global cardiac imaging software market owing to increasing cardiac patient inflow in the hospital for diagnosis and treatment. Besides the cardiac imaging software has been gaining major attention from hospitals due to its precise imaging quality and advanced features of software.

CARDIAC IMAGING SOFTWARE MARKET BY GEOGRAPHY

The global Cardiac Imaging Software market is studied for the following regions

- North America

- Europe

- Asia-Pacific

- Rest of the world (RoW)

The North American region is the dominant market. High incidence/prevalence of heart disease, large number of imaging centers in the region, ongoing research contribute to the growth of the cardiac imaging software market.

APAC is expected to witness significant growth during the forecast period as it consists of major developing countries, such as China, Japan, and India, and there is considerable scope for development for most of the industries. The region is also the fastest-growing market for cardiac imaging software. The growth of the market in the region is due to the presence of emerging countries, and their high economic growth rate, the rise in population, and the adoption of high-end medical technology.

COVID-19 IMPACT ANALYSIS ON GLOBAL CARDIAC IMAGING SOFTWARE MARKET

A 360 degree analysis of micro and macro-economic factors on the global Cardiac Imaging Software market is provided in this exclusive report generated by Axiom MRC. In addition, complete analysis of changes on the global Cardiac Imaging Software market expenditure, economic and international policies on supply and demand side is provided in this exclusive report. The report also studies the impact of pandemic on global economies, international trade, business investments, GDP and marketing strategies of key players present in the market.

During the COVID-19 pandemic, the use of cardiovascular computed tomography angiography test has witnessed a sudden increase in demand. Owing to the pandemic, a change in the use of particular cardiac imaging modalities have been seen. Computed tomography angiography can possibly be used as an alternative to invasive coronary angiography for the diagnosis of acute coronary syndrome, this would help prevent spreading of COVID-19 in the catheterisation lab. Additionally, cardiac magnetic resonance imaging or computed tomography scans can also be used as option to transesophageal echocardiography (TOE) because of surged risk of contamination of personnel and equipment with TOE. Also, if TOE is indicated in a patient with COVID-19, it may be possible to perform a focussed cardiac ultrasound study as an alternative. Thus factors such as rising complications of heart related diseases owing to COVID-19 and increasing use of cardiac imaging modalities such as MRI and CT scan are the factors expected to have a positive impact on the growth of cardiac imaging software market.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of Cardiac Imaging Software market is majorly focused on expanding the global growth of Cardiac Imaging Software sector with new product innovation, business expansion, increasing presence of range of manufacturers operating in Cardiac Imaging Software industry has led the growing demand for the market. Besides, the market offers range of products in different application to fulfil the required demand of consumers which is further contributing healthy growth in the market.

The key players studied in market are

- Agfa-Gevaert Group

- Canon Inc

- CardioComm Solutions Inc.

- Circle Cardiovascular Imaging Inc.

- eMedica

- S.L, Fujifilm Holdings Corporation

- GE Healthcare

- MEDIS Medical Imaging Systems

- Pie Medical Imaging

- Positron Corporation,

- Shimadzu Corporation

- Siemens Healthcare

RECENT DEVELOPMENT:

June 2021: GE Healthcare had partnered with the American College of Cardiology (US) to develop artificial intelligence and digital health technology in cardiology.

March 2021: TeraRecon was acquired by Symphony Innovation, LLC. Symphony AI Group had begun its new range of healthcare AI solutions centered on medical imaging with this purchase.