Digital payment is a form of transaction that takes place via digital or online mode, with no physical exchange of money involved. Increasing adoption of digital payment modes in the BFSI sector significantly drives the growth of the market. Credit cards, debit cards, ATM cards, NFC cards or mobile devices, mobile banking, digital eWallets are just some of the examples of digital payment technologies.

Digital Payment Market Dynamics

The high adoption rate of smartphones, increased e-commerce sales, and improved internet penetration globally are expected to benefit the industry. Governments across the globe are undertaking initiatives to digitize payments. This promotes economic prosperity and benefits end-users in many countries across the globe. For instance, Mexico's central bank announced the launch of CoDi, a smartphone payment system, in February 2019 to reduce cash transactions in the country.

COVID 19 Impact on Digital Payment Market

Covid19, drastically affects the world supply chain and industrial sector growth. At the initial stages of the pandemic, the world experienced, ‘supply shocks’. In the foreseeable future, the COVID-19 pandemic has accelerated the existing trend toward digital marketplaces. The pandemic has accelerated the acceptance of contactless and wallet payments. EWallets are seeing increased traction for peer to peer (P2P) transactions, bill payments, and customer to business (C2B) payments for essential necessities due to lock-down and aversion to cash exchange. However, some wallet providers have raised their fees for merchants and users, leading merchants not to accept their wallets for transactions.

Digital Payment market segmental overview

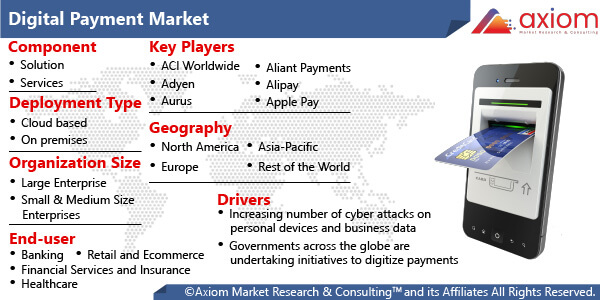

The report analyses the digital payment market based on component, organization size, deployment type, vertical, and geography.

Digital Payment Market by Component

By component, the global digital payment market is segmented into solutions and services. Solution segment is again bifurcated into payment gateway solutions, payment processing solutions, payment wallet solutions, payment security and fraud management solutions, and point of sale solutions. The payment wallet solutions segment to grow at a higher cagr during the forecast period. Mobile network operators (mnos), mobile virtual network operators (mvnos), banks, and financial institutions use payment wallet solutions to launch their digital wallets. These solutions are designed to provide customers with a secure, intuitive, simple and convenient payment experience.

Digital Payment by Organization Size

By organization size, the global digital payment market is segmented into small and medium-sized enterprises and large enterprises. Large enterprises segment is expected to hold a higher market share. Digital payment solutions are adopted by large companies due to the need to digitize their payment landscape, respond to dynamic customer patterns, streamline business processes and improve market competitiveness.

Digital Payment Market by Deployment Type

The global digital payment by deployment type is classified into on-premise and cloud. The cloud segment is expected to register the highest cagr in the forecast timeframe. The segment's growth is being fueled by the continued deployment of smart cities and an increase in the number of unmanned retail stores.

Digital Payment Market by Vertical

The global digital payment by vertical is classified into banking, financial services, and insurance, retail and ecommerce, healthcare, travel and hospitality, transportation and logistics, media and entertainment and others. In 2020 the BFSI segment dominated the market. The increase in remittances to low-and middle-income countries is projected to be one of the main drivers of new market growth opportunities over the forecast period. In addition, banks are also expanding their services to compete with providers of digital payment solutions such as Google, Amazon and Facebook.

Digital Payment Market by Geography

Geographically, the Digital Payment market is studied across the countries of key regions such as, North America, Europe, Asia Pacific and the rest of the world regions which includes Latin America, and Middle East & Africa. The increasing implementation of smart parking meters, as well as technological advancements in these meters, are driving demand for digital payment solutions in the North American region. For instance, the San Francisco Municipal Transportation Agency announced in December 2017 that it would introduce a "demand-responsive pricing" system on 28,000 smart parking meter.

Digital Payment Key Players

Some of the major players operating in this market include ACI Worldwide (US), Adyen (Netherlands), Aurus (US), Aliant Payments (US), Alipay (China), Apple Pay (US), Due (US), Dwolla (US), FattMerchant (US), FIS (US), Fiserv (US), Global Payments (US), Intuit (US), JPMorgan Chase (US), Mastercard (US), PayPal (US), Paysafe (UK), PayTrace (US), PayU (Netherlands), and Spreedly (US), Square (US).