Adipic acid is a dicarboxylic acid which contains two carbonyl group. It is naturally found in sugar cane and beets. It is synthesized from benzene and crude oil. It is used to manufacture lubricant components and plasticizes, about 90% of adipic acid is used to make nylon. In food industries, it is used as an acidulant, leavening agent, buffering agent, gelling aid and gives tart & sweet flavor. It is also used in medicine to control the acid and base concentration.

Market Dynamics – Adipic Acid Market

An increase in demand for adipic acid in electrical & electronics, automotive, consumer goods, and appliance industry are the main drivers of the market. R & D in textiles production is also helping the market to grow, as companies are focusing on lightweight, durable, high quality, and high absorption quality which are capable during extreme conditions like chemical and temperature. The presence of some environmental restriction rules and regulations in some regions, fluctuation in raw material price, and increasing use of hybrid fiber are the main restraints of the adipic acid market.

ECONOMIC IMPACT OF COVID 19 ON ADIPIC ACID MARKET

The exclusive COVID 19 impact analysis provides an analysis of micro and macro-economic factors on the adipic acid market. In addition, complete analysis of changes on healthcare expenditure, economic and international policies on supply and demand side. The report also studies the impact of the pandemic on global economies, international trade, business investments, GDP, and marketing strategies of key players present in the market. The Covid-19 epidemic has led to a positive impact on the growth of the packaging industry. Though, it has given rise to demand for plastic packaging. Which helps the adipic acid market to grow in pandemic. Food & beverage packaging has observed a high demand during the pandemic, as consumers have been more tending toward packaged food products due to factors such as maintaining hygiene and safety.

ADIPIC ACID MARKET - SEGMENTAL OVERVIEW

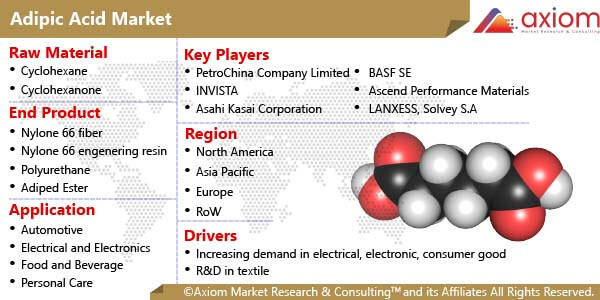

The study analyzed the global adipic acid market based on raw material, end product, application, end-user industry, and geography.

ADIPIC ACID MARKET BY END PRODUCT

Nylon 66 fibers, nylon 66 engineering resins, polyurethanes, and adipate esters are the end product of the adipic acid market. Polyurethane is likely to emerge as the fastest-growing segment over the forecast period accounting for the highest share in the adipic acid market. There is a high demand for innovative PU foams in several end-use industries on account of their durability, versatility, low cost, and high functionality. These foams are considered excellent and safe filling materials for mattresses and seating cushions.

ADIPIC ACID MARKET BY APPLICATION

Adipic acid is mostly used in automotive, electrical and electronics, textiles, food and beverages, personal care, pharmaceutical, and other end-user industries. Almost 13.7% of the total adipic acid demand was for automotive applications, with the industrial/machinery segment also being the fastest-growing end-use segments, primarily due to their high penetration in all the regions. The drivers of the industry are stringent government regulations, increasing pressure for clean air and water, and the need to improve the standard of processing and manufacturing end-products.

ADIPIC ACID MARKET BY GEOGRAPHY

The Asia Pacific is dominating the global adipic acid market in terms of volume. High demand from automotive sector chief market of raw material and relaxing rule and regulation in countries like China and India which helps the market to grow. Followed by the Asia Pacific, Middle East, and Africa is the most promising region in term of growth due to relaxing rules and regulation and easily presence of raw material. In terms of revenue, North America is the largest market, as it has more demand for adipic acid due to the presence of textile industries, and pharmaceutical industries. An increase in the food & beverage and automotive sector in this region helps the market to grow.

ADIPIC ACID MARKET KEY PLAYERS

Major players in the global adipic acid market PetroChina Company Limited, INVISTA, Asahi Kasai Corporation, BASF SE, Ascend Performance Materials, LANXESS, Solvey S.A., Radici Partecipazioni SpA, Bioamber Inc, Sumitomo Chemical Co. Ltd., Shandong Hongye Chemical Company Ltd., PetroChina Liaoyang Petrochemical, among others.